Cascading Payments: Turning Declines into Opportunities

Declined payments are a frustrating reality for merchants. Every decline represents a lost opportunity, both in revenue and customer trust. But here’s the good news: many of these declines are preventable or recoverable with the right tools.

That’s where cascading payments come in. By retrying failed transactions with fallback acquirers in a strategic, automated way, cascading helps merchants recover lost sales, smooth out payment flows, and improve customer satisfaction. In this article, we’ll explore how cascading works, how it addresses different payment failure scenarios, and actionable strategies for maximizing its effectiveness.

The Cost of Declined Transactions

Every declined payment represents more than just lost revenue, it’s a potential loss of a loyal customer. Globally, merchants lose $20.3 billion annually due to false declines.. What’s worse, 62% of these customers don’t retry their purchase after a failed transaction.

That’s where cascading payments come in. By intelligently retrying failed payments with fallback acquirers, merchants can turn these missed opportunities into successful transactions. But to truly harness cascading, it’s essential to understand how it works and how to apply it strategically.

What is Cascading in Payments?

Cascading payments (also known as Smart Dynamic Routing, or SDR) is a retry mechanism set in payment gateways designed to save failed transactions. When a payment fails, due to temporary issues like network glitches or acquirer timeouts, the system automatically reroutes it to a different, pre-configured fallback acquirer. The goal? To give the transaction a second (or third) chance at approval without additional action from the customer.

Think of it as a safety net: if one acquirer declined a payment, cascading ensures another can catch it before it’s completely lost. Unlike general smart routing, which optimizes the first attempt, cascading kicks in after a failure, making it a vital tool for recovering revenue.

Why Payments Fail

To appreciate cascading’s impact, let’s first explore the common reasons behind payment failures:

- Soft Declines: These are temporary issues like network glitches, acquirer timeouts, or insufficient fraud scoring. Soft declines are often recoverable through immediate retries.

- Hard Declines: These are more permanent issues, such as an invalid card, stolen card, a closed account, insufficient funds or fraud suspicions. Retrying won’t usually resolve a hard decline unless the underlying issue changes (e.g., the customer updates their payment details).

- Data Errors: Sometimes, the problem lies in incomplete or incorrect payment information (e.g., wrong CVV or mismatched billing address)

Issuing banks play a key role here. They’re responsible for authorizing or rejecting a payment based on factors like account balance, fraud checks, and transaction risk levels. Understanding their decision-making process is critical to optimizing cascading strategies.

How Cascading Works in Practice

Here’s how cascading typically unfolds:

- A customer attempts to make a payment, which is routed to the primary acquirer.

- The acquirer rejects the transaction (e.g., due to a soft decline).

- Cascading is triggered, automatically retrying the transaction with a fallback acquirer.

- If necessary, additional fallback acquirers are engaged until the transaction is approved or all options are exhausted.

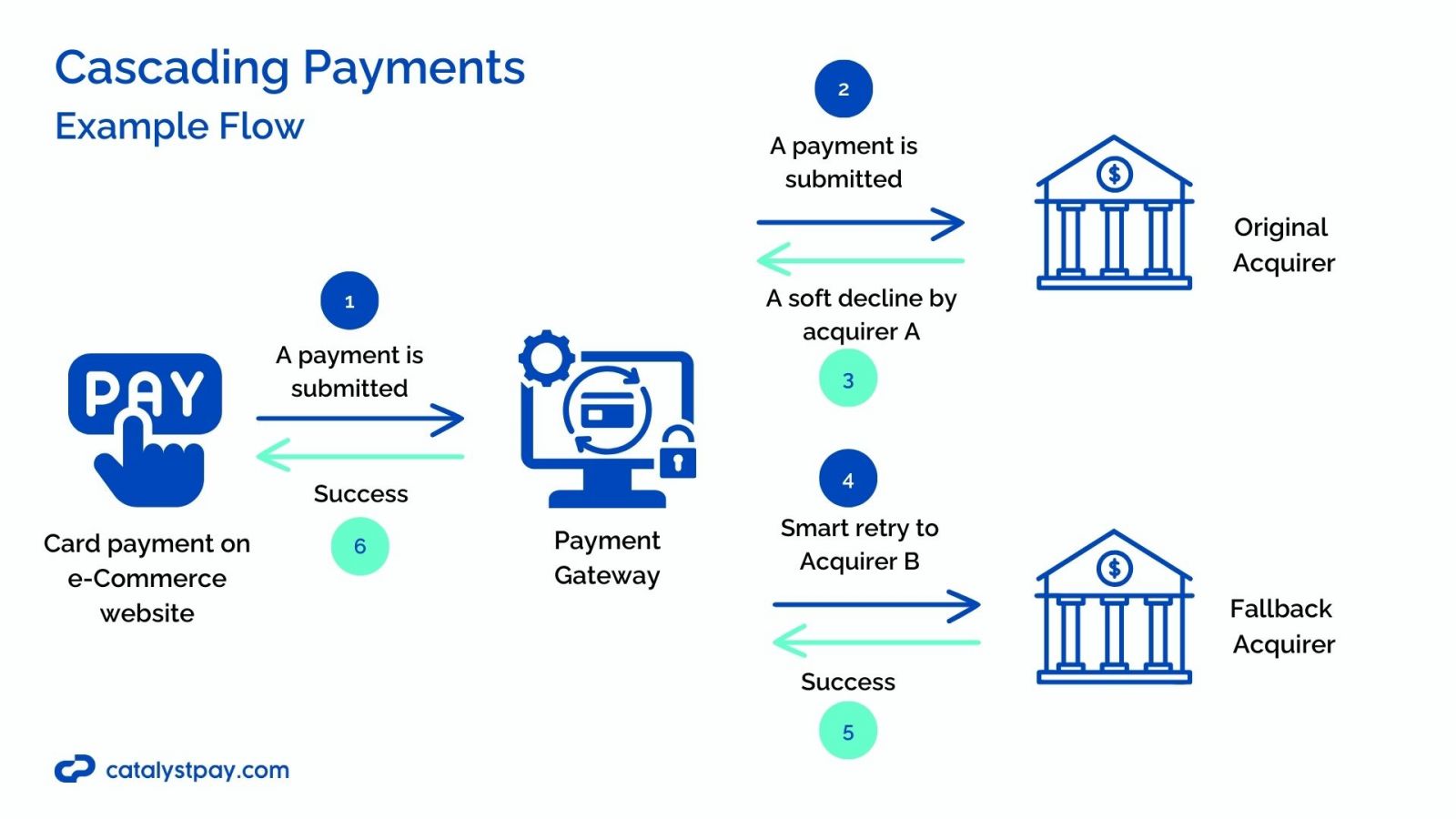

Example of Cascading in Action

Let’s take a hypothetical example to better illustrate cascading in action.

A customer is purchasing a product on an international e-commerce site:

- Initial Attempt: The payment is routed to Acquirer A but fails due to a network issue at the acquirer (soft decline).

- Retry: The system automatically reroutes the transaction to Acquirer B, which supports 3D Secure. The fallback acquirer triggers Strong Customer Authentication (SCA), the customer completes the authentication challenge, and the payment is approved.

This simplified scenario demonstrates how cascading ensures the recovery of failed payments by leveraging fallback acquirers with the right capabilities. Instead of losing the sale, the merchant successfully processes the transaction while minimizing customer friction.

Cascading Strategies: Use Cases for Merchants

Not all declines should be treated equally. Soft declines, for instance, are prime candidates for immediate retries, while hard declines require more thoughtful approaches, such as waiting a few days for resolution.

Here are some proven strategies to optimize cascading across key use cases:

Soft Declines (Temporary Issues)

Use Case: A payment fails because the acquirer’s system times out or flags the transaction for additional checks.

Solution: Automatically retry the transaction with a fallback acquirer.

Example: A soft decline occurs with Acquirer A. Cascading retries it with Acquirer B, which successfully processes the transaction.

This strategy works well when payment dispatching is enabled, fraud management tools are active, and 3D Secure v2 is configured.

Hard Declines (Insufficient Funds)

Use Case: A subscription payment fails due to insufficient funds in the customer’s account.

Solution: Schedule retries over time to allow the customer’s funds to replenish.

Example: A merchant sets up cascading retries at intervals of 3, 5, and 7 days. The second retry succeeds after the customer’s payday.

This approach is particularly effective for subscription businesses, where retaining customers is critical.

Cross-Border Payments

Use Case: A payment fails with the primary acquirer due to poor regional coverage.

Solution: Route the transaction to a fallback acquirer with strong local presence or regional expertise.

Example: A payment from a customer in Asia fails with a European acquirer but succeeds with a fallback acquirer specializing in APAC transactions.

This strategy ensures smoother international transactions and fewer declines caused by geographic mismatches.

Best Practices for Cascading

Understand Decline Reasons: work closely with your payment provider to analyze why transactions are failing. Are declines due to soft or hard reasons? Is a particular BIN underperforming? Use this data to refine your retry configurations, targeting fallback acquirers that address specific decline causes.

Combine Cascading with Smart Routing: While cascading focuses on recovering failed payments, smart routing ensures the initial transaction is sent to the most optimal acquirer. Together, these approaches create a seamless system:

- Smart routing ensures higher first-pass success rates by selecting acquirers based on factors like geographic performance, BIN preferences, and transaction type.

- Cascading acts as a safety net, retrying any transactions that fail despite smart routing.

Monitor Costs and Avoid Over-Retries: Cascading retries incur fees, including interchange and acquirer costs. Excessive retries, especially for hard declines, can be counterproductive. Aim for intelligent retry configurations:

- Limit retries for hard declines.

- Prioritize retries for soft declines, which are more likely to succeed.

Combine Cascading with Checkout Optimization: Tokenization and features like one-click payments reduce initial declines, making cascading a safety net rather than a default strategy.

Measure and Adjust: Monitor retry success rates, decline reasons, and fallback acquirer performance. Use this data to continuously improve your cascading and smart routing strategies.

Prerequisites for Implementing Cascading

Before you implement cascading, you need to ensure the right infrastructure and processes are in place. Cascading isn’t just about retrying payments, it involves strategic planning, the right tools, and a clear understanding of its implications. Here’s what you’ll need:

1. Multi-Acquirer Strategy

Cascading relies on having multiple acquirers available for fallback attempts. Without this, there’s no redundancy to recover failed transactions. Different acquirers can perform better based on geography, industry, or BIN-specific rules. A multi-acquirer strategy allows you to optimize approval rates by leveraging these strengths. Partner with acquirers suited to your business’s operational and regional needs, ensuring they support fallback mechanisms for cascading.

Pro Tip: Choose acquirers with regional expertise for cross-border transactions to maximize local approval rates.

2. Budget for Costs

Every retry in cascading is treated as a new transaction, which means it incurs the same fees as the initial payment attempt. These include interchange fees, acquirer fees, and any applicable gateway fees.

How to manage costs:

- Focus retries on soft declines, as these are more likely to succeed and recover revenue.

- Limit retries for hard declines, which often require customer action to resolve.

Pro Tip: Work with your payment provider to monitor retry success rates and identify where cascading provides the best return on investment.

3. A Payment Gateway that Supports Cascading

Your payment gateway must enable cascading by dynamically rerouting failed transactions to fallback acquirers. Key features to look for:

- Smart retry logic that adapts to soft and hard decline scenarios.

- Seamless integration with multiple acquirers for efficient fallback routing.

- Tokenization and account updater services to address issues like expired or replaced cards.

4. Real-Time Data Insights

To maximize cascading’s effectiveness, access to actionable data is essential. You’ll need:

- Clear visibility into decline reasons (e.g., network issues, invalid CVV, fraud flags).

- Metrics to monitor retry performance and fallback acquirer efficiency.

- Detailed transaction histories to evaluate cascading’s impact on approval rates.

Work closely with your PSP and use this data to refine retry logic and adjust fallback strategies for better results.

5. Fraud and Compliance Alignment

Cascading must align with fraud prevention and compliance measures. Pair cascading with fraud management tools to reduce false declines without compromising security. Your system should:

- Avoid unnecessary declines by syncing retry logic with fraud detection tools.

- Maintain PCI DSS compliance by securely handling sensitive cardholder data.

- Enable Strong Customer Authentication (SCA) for retries requiring 3D Secure.

Final Thoughts

Cascading is more than a technical solution—it’s a strategic advantage. By addressing the root causes of declines and leveraging fallback acquirers, merchants can recover lost revenue, enhance customer trust, and streamline operations.

Ready to unlock the full potential of cascading payments? Contact CatalystPay today to learn how we can help.