What is a Payment Gateway?| A Comprehensive Guide

- 17 min read

- 12 july 2022

Fast and secure online payment processing is critical for businesses of all sizes. Whether you're running a small e-commerce site or a global online marketplace, understanding the meaning and details of payment gateways is essential for protecting your business and providing a smooth transaction experience for your customers. This guide will explore what a payment gateway is, how it works, and why it is a vital component of any online business. Additionally, we'll delve into the types of payment gateways available, the benefits they offer, the costs involved, and future trends to keep an eye on.

What is a Payment Gateway?

A payment gateway is a technology that facilitates the secure transfer of payment information from a customer’s credit or debit card to the acquiring bank. This process involves verifying the cardholder's details and ensuring the availability of funds before authorizing the transaction. Once verified, the payment gateway sends the transaction data back to the cardholder, indicating whether the payment was accepted or declined. This secure process is vital for protecting sensitive information, ensuring that it is encrypted and transmitted safely from the cardholder to the acquirer through the merchant. This is usually handled by payment service providers (PSPs).

The Role of Payment Gateway in Online Business

Online payment gateways serve as an intermediary between merchants and customers, significantly simplifying the integration of various payment methods. By providing a secure environment for transactions, payment gateways help reduce the risk of fraud, especially in card-not-present transactions. These transactions, which occur on websites rather than at physical point-of-sale (POS) terminals, are more susceptible to fraud because merchants cannot physically verify the validity of the card.

Payment gateways protect merchants from various risks such as expired cards, insufficient funds, inactive accounts, and exceeded credit limits. Without the robust security provided by payment gateways, sensitive customer data could be exposed to hackers, leading to fraudulent activities that could result in significant financial and reputational damage for both merchants and customers.

A multi-currency payment gateway is particularly advantageous for businesses with a global customer base, allowing them to accept and process payments in various currencies, thus facilitating international transactions.

Types of Payment Gateways

There are several types of payment gateways available, each catering to different business needs. Understanding these types can help you choose the most suitable one for your business:

-

Hosted Payment Gateways: These gateways redirect customers to a secure page for payment processing. Examples include PayPal, Stripe, and Square. Hosted gateways handle all the payment processing, reducing the burden of PCI DSS compliance for merchants.

-

Self-Hosted Payment Gateways: In this type, the payment details are collected on the merchant's website by embedding a payment widget, but the processing is handled by the gateway provider. This type allows for more customization but requires a higher level of security management.

-

API or Non-Hosted Payment Gateways: These gateways allow merchants to have full control over the payment process by using APIs to integrate the gateway directly into their website. While this offers the most flexibility and control, it also demands stringent PCI DSS compliance and robust security measures.

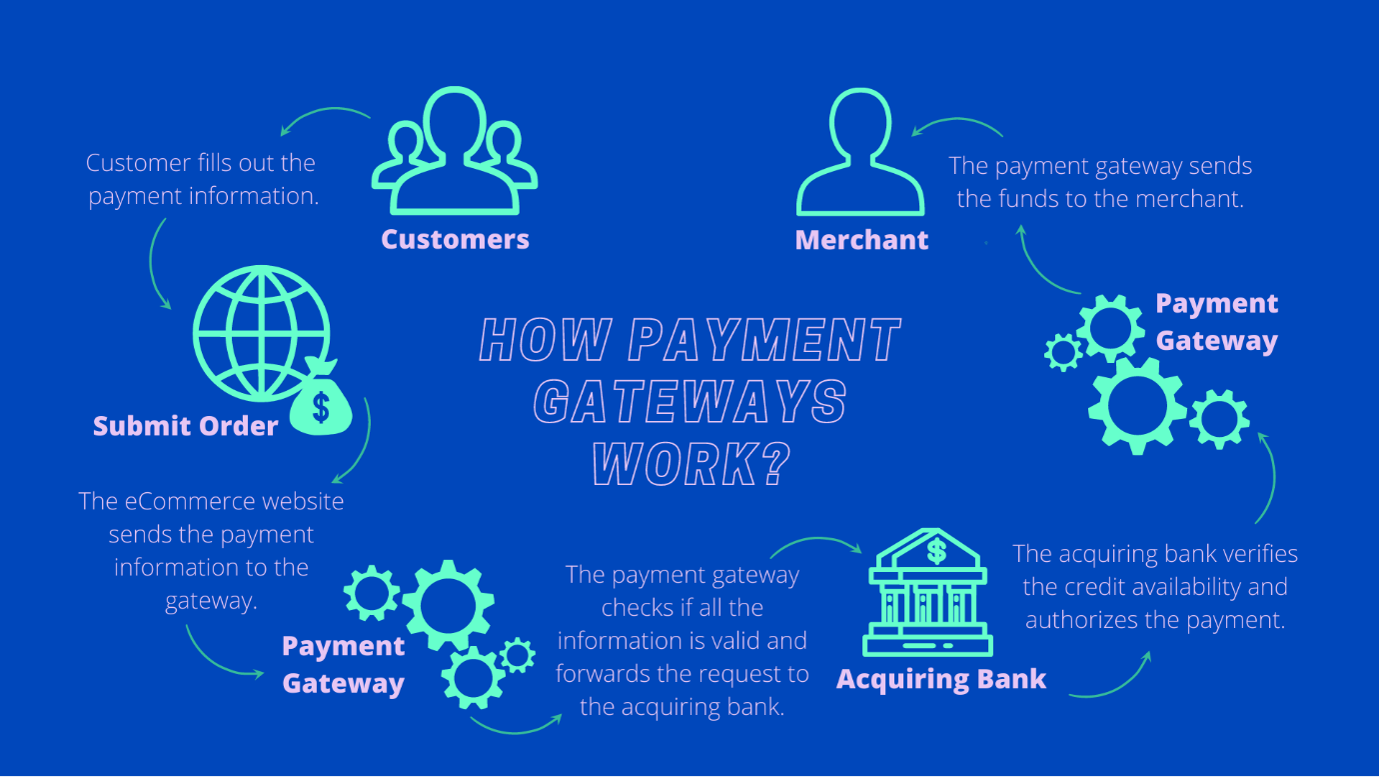

How does a Payment Gateway work?

-

Customer Initiates Payment: The cardholder selects a product or service and proceeds to the payment page. Payment gateways offer several integration options:

- Hosted Payment Page: The customer is redirected to a secure checkout page, reducing the merchant's burden of complying with PCI DSS (Payment Card Industry Data Security Standard) requirements.

- Server-to-Server Integration: This method allows the payment to be processed directly on the merchant’s server, improving the user experience by keeping the customer on the merchant's site.

- Client-Side Encryption: Card data is encrypted on the customer’s device before being sent to the merchant’s server, further enhancing security and reducing PCI DSS obligations.

-

Data Entry and Submission: The customer enters their card details, including the cardholder name, expiration date, and CVV number, which are then securely transferred to the payment gateway.

-

Fraud Checks and Encryption: The payment gateway encrypts the data and conducts fraud checks to ensure the transaction's validity before sending the information to the acquiring bank.

-

Acquiring Bank Processing: The acquiring bank forwards the transaction details to the relevant card networks (such as Visa, MasterCard, or American Express).

-

Card Network Verification: The card networks perform additional security checks and forward the transaction data to the issuing bank.

-

Issuing Bank Authorization: The issuing bank verifies the transaction details and either approves or declines the payment. This response is sent back to the acquiring bank via the card network.

-

Notification of Outcome: The acquiring bank sends the transaction outcome to the payment gateway, which then informs the merchant. If approved, the payment amount is transferred from the issuing bank to the merchant’s account.

-

Customer Confirmation: The cardholder receives a confirmation message indicating whether the payment was successful or if they need to try an alternative payment method.

- Settlement: On a predetermined settlement day, usually once a week, the acquiring bank releases the funds to the merchant’s bank account.

This entire process, despite its complexity, typically takes just a few seconds to complete, ensuring a smooth and efficient transaction experience for both merchants and customers.

Benefits of Using a Payment Gateway

Utilizing a payment gateway offers numerous benefits to both merchants and customers:

-

Enhanced Security: Payment gateways provide encryption and secure data transmission, protecting against fraud and unauthorized access. They also ensure compliance with PCI DSS standards, which is crucial for safeguarding sensitive payment information.

-

Global Reach: With the ability to process payments in multiple currencies, payment gateways enable businesses to expand their market reach and cater to international customers.

-

Increased Conversion Rates: A seamless and secure checkout process reduces cart abandonment rates, leading to higher conversion rates and increased sales.

-

Automated Payment Processing: Payment gateways automate the payment process, reducing manual errors and saving time for businesses.

-

Comprehensive Reporting: Many payment gateways offer detailed transaction reports, helping businesses monitor sales, manage refunds, and optimize their payment strategies.

The Difference Between a Payment Gateway and a Payment Processor

While the terms payment gateway and payment processor are often used interchangeably, they refer to different components of the payment process. Understanding the difference between the two is crucial for making an informed decision:

-

Payment Gateway: As discussed, a payment gateway is the technology that authorizes and secures the transfer of payment information from the customer to the acquiring bank. It acts as the digital equivalent of a point-of-sale terminal in physical stores.

-

Payment Processor: The payment processor is the entity responsible for handling the actual transaction, moving funds from the customer's account to the merchant's account. Payment processors work behind the scenes and are often integrated with payment gateways to complete the transaction.

Check also our detailed article about the difference between payment gateway and payment processor.

Businesses may choose to work with a Payment Service Provider (PSP) that offers both gateway and processor services, streamlining the payment process and ensuring compatibility between the two components.

Payment Gateway Fees and Costs

Understanding the cost structure of payment gateways is essential for budgeting and pricing strategies. Payment gateways typically charge the following types of fees:

-

Setup Fees: Some payment gateways charge a one-time fee to set up the service and integrate it with your website.

-

Transaction Fees: These are the most common fees, also know as processing fees or MDR (merchant discount rates), and are usually a percentage of each transaction or a fixed fee per transaction. It’s essential to understand its structure and to compare rates across different providers to find the most cost-effective solution.

-

Monthly Fees: Some gateways charge a recurring monthly fee for access to their services. This fee may vary based on the volume of transactions or additional features like fraud protection or advanced reporting.

-

Chargeback Fees: If a customer disputes a transaction, you may be charged a fee for handling the chargeback process. Minimizing chargebacks through robust fraud prevention measures can help reduce these costs.

By carefully considering these fees and choosing a gateway that aligns with your business model, you can optimize your payment processing costs and improve profitability.

Payment Gateway Integration Best Practices

1. Ensure PCI Compliance: Whether you handle card data directly or use a third-party gateway, it’s crucial to comply with PCI DSS (Payment Card Industry Data Security Standard) requirements to protect customer information and avoid hefty fines. For businesses that prefer to minimize their PCI burden, using a payment widget or a self-hosted payment gateway can be an effective solution. These options allow merchants to maintain a seamless customer journey without redirecting users to an external payment page, thus keeping the entire transaction process within their website while still offloading most of the PCI compliance responsibilities to the gateway provider.

2. Choose the Right Type of Payment Gateway: Selecting the appropriate payment gateway type is essential based on your business's needs and technical capabilities. If your business is not PCI compliant or has in-house technical expertise, a payment widget or self-hosted gateway can be a practical solution. These gateways allow you to offer a smooth, integrated payment experience without the complexity of handling sensitive data directly. On the other hand, if your business has in-house technical competence, you might consider API or non-hosted gateways that offer greater customization and control over the payment process.

3. Test the Integration: Before going live, thoroughly test the payment gateway integration to identify and resolve any issues. This includes testing various scenarios, such as successful payments, declined transactions, refunds, and handling different payment methods. This ensures that the gateway functions smoothly under all conditions and provides a positive user experience.

4. Optimize for Mobile: With the increasing use of mobile devices for online shopping, ensure that your payment gateway is mobile-friendly and provides a seamless experience on all devices. This includes responsive design, easy-to-use mobile interfaces, and quick loading times to prevent cart abandonment and improve conversion rates.

5. Provide Multiple Payment Options: Offering a variety of payment methods, such as credit cards, debit cards, e-wallets, and local payment options, can increase customer satisfaction and reduce cart abandonment rates. It's essential to cater to different customer preferences, especially in international markets where preferred payment methods may vary.

6. Leverage E-commerce Plugins for Fast Integration: For businesses using platforms like WooCommerce, OpenCart, or Shopify, there are numerous plugins available that allow for fast and straightforward payment gateway integration. These plugins are designed to work seamlessly with your e-commerce platform, providing an easy setup process and ensuring compatibility. This is especially beneficial for small to medium-sized businesses that may not have the resources for extensive custom integration.

7. Assess In-House Technical Competence and Support: Some payment gateway integration methods can be complex and may require significant technical expertise. If your business does not have an in-house IT team, it’s crucial to choose a payment gateway solution that offers robust technical support or opt for a simpler integration method like a hosted payment page or a pre-built plugin. Additionally, ongoing support is essential to address any technical issues that may arise, ensuring your payment system remains reliable and secure.

8. Monitor and Analyze Performance: Regularly review transaction reports and analytics provided by the payment gateway to identify trends, optimize payment processes, and address any issues promptly. Monitoring performance also helps in detecting fraudulent activities early and making data-driven decisions to enhance the payment experience.

By following these best practices, you can ensure that your payment gateway integration is not only efficient and secure but also tailored to meet the specific needs of your business, providing a seamless payment experience for your customers.

Wrapping Up

Choosing and integrating the right payment gateway is pivotal for any online business. By aligning your payment solutions with your technical capabilities and customer needs, you ensure smooth transactions and build trust. Whether you're tapping into easy-to-use plugins or opting for more tailored setups, the goal remains the same: secure, efficient, and user-friendly payments. Stay updated with emerging trends, prioritize security, and you'll be well on your way to satisfying customers and boosting your online success.

Need help finding the right payment gateway solution for your business? Contact us today, and let's work together to optimize your payment process and grow your business.