What Are Chargeback Management Companies And Why Businesses Should Consider Them

In this article, we’ll address why managing chargebacks efficiently is crucial for any business that handles electronic payments, what chargeback management companies are and why you should consider working with them. Chargebacks are essentially reversed transactions, initiated by the cardholder or the card-issuing bank, often due to disputes over fraudulent transactions, unauthorized charges, or dissatisfaction with a product or service. These can significantly impact your business’s bottom line, which means that finding effective chargeback management companies is indispensable.

What is a Chargeback?

A chargeback is a consumer protection mechanism that allows cardholders to dispute a transaction and reclaim funds if they believe the transaction was unauthorized, fraudulent, or resulted from an error. This process, while beneficial for consumers, aims to provide a safeguard against unethical practices and ensures that cardholders are not unfairly charged. When a chargeback is initiated, the issuing bank withdraws the disputed amount from the merchant's account and temporarily credits it back to the cardholder while the investigation is underway.

For businesses, chargebacks can raise significant financial and operational challenges. When a chargeback is issued, the merchant not only loses the sale amount but may also incur additional fees. Repeated chargebacks can lead to higher processing fees, increased scrutiny from payment processors, and in severe cases, the termination of merchant accounts.

Plus, handling chargebacks takes valuable time and resources because it involves gathering evidence, communicating with banks, and sometimes even engaging in a dispute resolution process.

How Chargeback Management Companies Operate

Chargeback management companies specialize in mitigating the impact of chargebacks on businesses by handling disputes, preventing fraudulent transactions, and recovering lost revenue. These companies typically follow a comprehensive process that includes several key components.

Transaction Monitoring

Chargeback management companies continuously monitor transactions to detect suspicious activities in real-time. This involves using advanced algorithms and machine learning techniques to identify patterns that may indicate fraudulent behavior. By analyzing transaction data, these companies can flag potentially fraudulent transactions before they are completed, reducing the likelihood of chargebacks.

Dispute Management

A significant part of chargeback management is handling the communication and resolution process with banks and customers. Chargeback management companies act as intermediaries between the merchant and the issuing bank, making sure that disputes are addressed fast and efficiently. They gather and present evidence to support the merchant's case, which increases the chances of a favorable resolution.

Chargeback management companies also leverage industry-specific tools and services to enhance their dispute management processes. For instance, Visa's Rapid Dispute Resolution (RDR) service allows merchants to automate dispute resolutions by establishing predefined rules, resolving disputes instantly and reducing manual intervention. Similarly, MasterCard collaborates with chargeback management companies to provide tools and services that streamline the dispute resolution process, ensuring faster resolutions and minimizing the impact on the business.

Fraud Prevention

Implementing robust fraud prevention strategies is another critical function of chargeback management companies. This includes deploying tools such as address verification systems (AVS), card verification value (CVV) checks, and two-factor authentication to verify the authenticity of transactions.

Data Analysis

By examining historical transaction data, chargeback management companies can identify trends and potential vulnerabilities in the merchant's payment process. This analysis helps in developing targeted strategies to mitigate future risks and enhance overall transaction security.

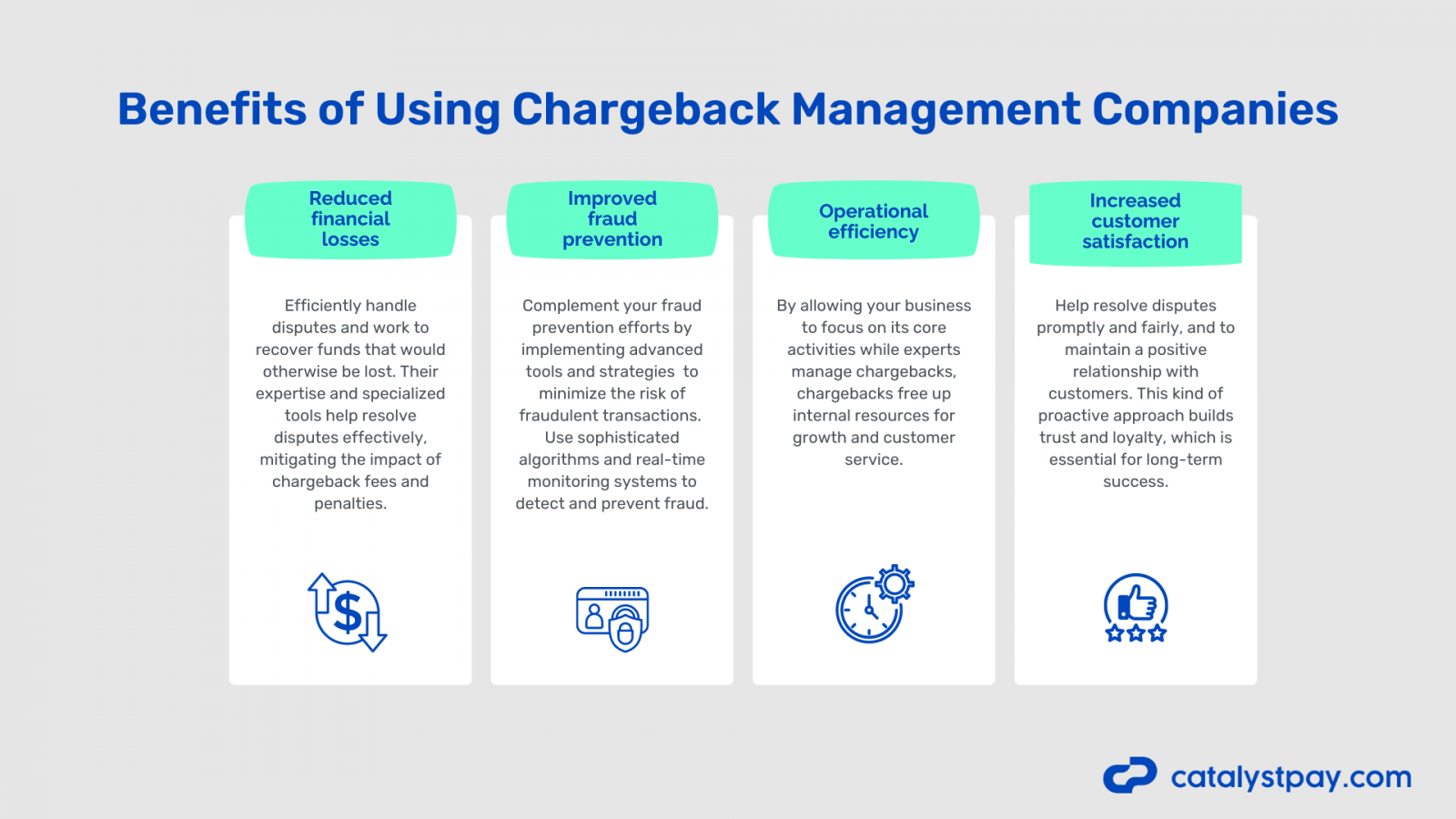

Benefits of Using Chargeback Management Companies

Employing the services of chargeback management companies offers several benefits. By outsourcing chargeback management to a trusted partner, you can improve your financial stability, operational efficiency, and customer satisfaction.

- Reduced financial losses - chargeback management companies efficiently handle disputes and work to recover funds that would otherwise be lost. Their expertise and specialized tools help resolve disputes effectively, mitigating the impact of chargeback fees and penalties;

- Improved fraud prevention - these companies complement your fraud prevention efforts by implementing advanced tools and strategies designed to minimize the risk of fraudulent transactions. They generally use sophisticated algorithms and real-time monitoring systems to detect and prevent fraud before it results in a chargeback;

- Operational efficiency - by allowing your business to focus on its core activities while experts manage chargebacks, chargebacks free up internal resources for growth and customer service;

- Increased customer satisfaction - these services help resolve disputes promptly and fairly, and to maintain a positive relationship with customers. This kind of proactive approach builds trust and loyalty, which is essential for long-term success.

Overview Of Prominent Chargeback Management Companies

When it comes to chargeback management, there are several companies that stand out for their innovative approaches and comprehensive services. Below, we explore some of the leading chargeback management companies, highlighting what makes each unique and how they can benefit businesses.

ChargebackHelp

ChargebackHelp provides merchant solutions against post-purchase revenue threats such as fraud, disputes and chargebacks. Their comprehensive platform enables merchants to deflect disputes, prevent chargebacks, and represent transactions to recover revenue from unwarranted chargebacks..

ChargebackHelp automates compelling evidence for effective representments. By using sophisticated technology and a team of experts, ChargebackHelp is able to offer real-time monitoring and detailed analytics, which provide actionable insights to prevent future chargebacks.

They are also known to have a proactive approach to make sure that potential issues are identified and addressed before they escalate, helping businesses maintain healthy revenue streams.

!Disclaimer - At CatalystPay, we partnered with ChargebackHelp because we strongly support their approach. Currently, our clients use their services and are happy with the personalized care they get.

Chargebacks 911

Chargebacks 911 is a specialist in helping businesses mitigate chargeback risks through a combination of technology, data analysis, and industry expertise. Their services cover dispute management, fraud prevention, and chargeback mitigation.

Chargebacks 911 stands out due to its innovative use of data to understand and combat chargeback sources. They offer comprehensive analytics that help businesses identify patterns and root causes of chargebacks. Their integration with various payment processors and platforms offers seamless management of disputes.

They also provide extensive educational resources and support, empowering businesses to adopt best practices in chargeback management.

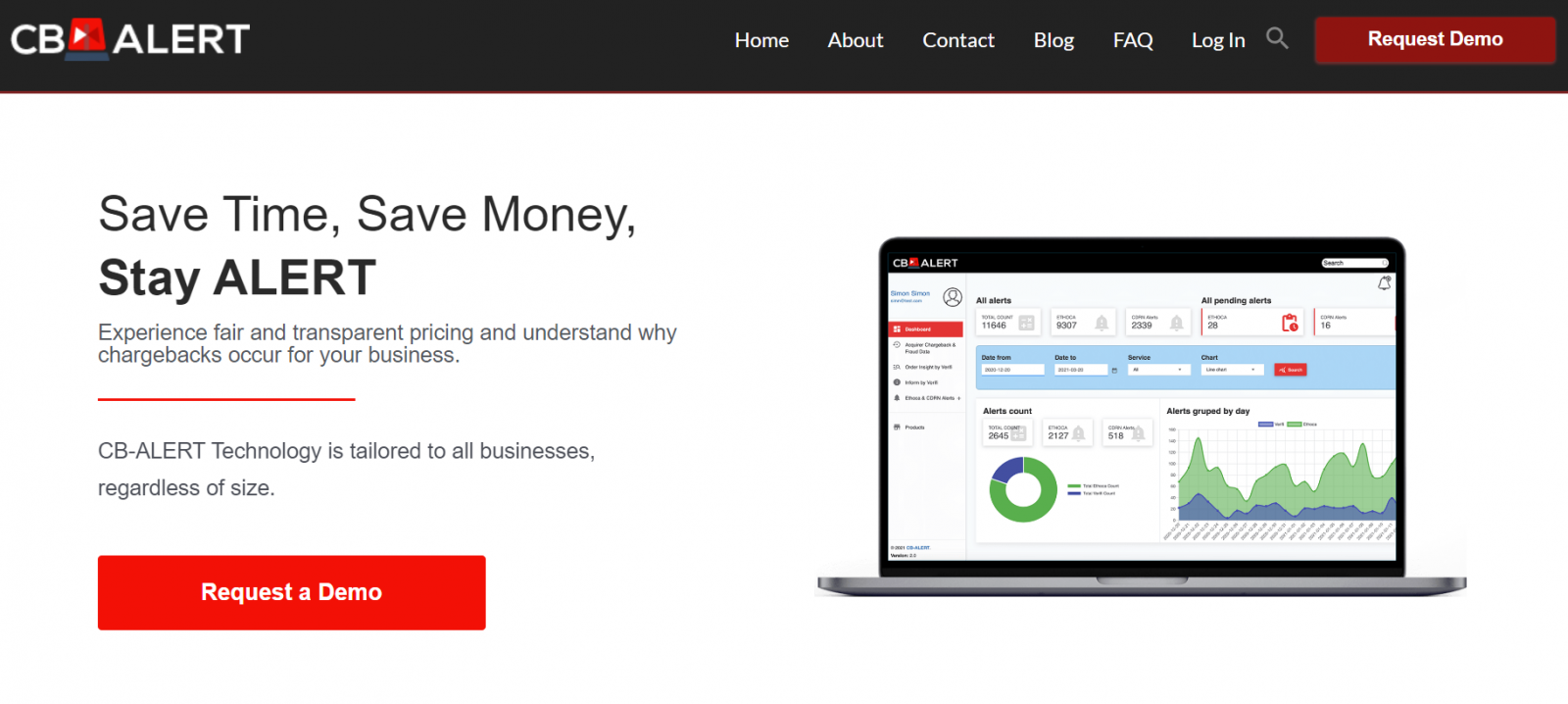

CB-ALERT

CB-ALERT offers a proactive approach to chargeback management, focusing on early detection and prevention of fraudulent transactions. Their solutions are designed to provide businesses with real-time alerts and actionable insights to minimize chargebacks. What sets CB-ALERT apart is their emphasis on real-time data and advanced machine learning algorithms.

Their system continuously analyzes transaction patterns to identify anomalies that could indicate potential fraud. By catching these early, CB-ALERT helps businesses avoid chargebacks before they occur.

ChargebackOps

ChargebackOps provides end-to-end chargeback management services, including dispute resolution, fraud prevention, and transaction monitoring. Their team of experts works closely with businesses to develop customized strategies that address specific chargeback challenges. ChargebackOps distinguishes itself through its personalized approach and dedicated support.

Their comprehensive service includes everything from initial dispute handling to in-depth analysis and continuous monitoring. ChargebackOps also offers extensive training and resources to help businesses understand the chargeback process and implement effective prevention measures.

Which Businesses Should Consider Chargeback Management Companies

Businesses of all sizes and industries can benefit from using chargeback management companies, but some sectors are more prone to chargebacks and can gain significantly from these services. Here are some types of businesses that should particularly consider chargeback management companies:

- E-commerce Retailers: Online stores are highly susceptible to fraudulent transactions and chargebacks due to the card-not-present nature of transactions. Chargeback management companies can help mitigate these risks.

- Subscription Services: Businesses offering subscription models often face disputes over recurring charges, making chargeback management crucial for maintaining customer relationships and revenue consistency.

- Travel and Hospitality: The travel industry is prone to chargebacks due to booking disputes, cancellations, and dissatisfaction with services. Effective chargeback management can help resolve these issues promptly.

- High-Risk Industries: Sectors like gaming, adult entertainment, and online gambling often experience higher chargeback rates due to the nature of their services and customer base. Specialized chargeback management is essential here.

- Startups and Small Businesses: Smaller businesses might lack the resources to handle chargebacks effectively. Outsourcing to a chargeback management company can save time, money, and stress, allowing these businesses to focus on growth.

- Digital Goods and Services: Sellers of digital products and services often face disputes over non-tangible goods. Chargeback management companies can help in providing the necessary evidence to contest these disputes successfully.

- Financial Services: Companies offering financial products or services, such as loans or investment platforms, are vulnerable to chargebacks and fraud. Professional chargeback management ensures these businesses remain compliant and secure.

How To Choose Chargeback Management Companies

When selecting a chargeback management company, you should consider several key factors to make sure your partner aligns with your business needs and goals:

- Experience and expertise - look for a company with a proven track record in managing chargebacks and preventing fraud, and keep in mind that experience in your specific industry can also be beneficial;

- Technology and tools - advanced technology and innovative tools are essential for effective chargeback management, so make sure the company offers real-time monitoring, analytics, and automated solutions;

- Customer support - excellent customer support is crucial, and the company you choose should provide clear communication channels and dedicated support to help you navigate everyday situations;

- Customization - the ability to tailor services to meet the specific needs of your business is important, so make sure you look for a provider that offers personalized strategies and solutions;

- Cost effectiveness - evaluate the cost versus the potential savings and benefits the company provides, to make sure that the services are within your budget and offer you the kind of tailored service you need.

Conclusion

Effective chargeback management is critical for maintaining financial health and operational efficiency in any business that handles electronic payments.

By partnering with reputable chargeback management companies, your business can mitigate the risks associated with chargebacks, improve customer satisfaction, and focus on growth.

As you navigate this landscape, consider the expertise, technology, and support these companies offer to keep your business well-protected against chargeback challenges.

FAQs

What are chargebacks and why do they occur?

Chargebacks are reversed transactions initiated by cardholders or banks due to disputes over fraudulent transactions, unauthorized charges, or dissatisfaction with a product or service.

How can chargeback management companies help my business?

Chargeback management companies help by handling disputes, preventing fraudulent transactions, and recovering lost revenue, thereby reducing financial losses and operational burdens.

Which types of businesses benefit the most from chargeback management services?

E-commerce retailers, subscription services, travel and hospitality, high-risk industries, startups, small businesses, and those selling digital goods and services benefit significantly from these services.

What factors should I consider when choosing a chargeback management company?

Main elements to consider while choosing a chargeback management partner are experience and expertise, technology and tools, customer support and service options, ability to customize services and be cost-effective.

How do chargeback management companies prevent fraud?

They use advanced algorithms, real-time monitoring, address verification systems, CVV checks, and two-factor authentication to detect and prevent fraudulent transactions before they result in chargebacks.