Visa’s Acquirer Monitoring Program (VAMP): What it is and Upcoming Changes in 2025

The Visa Acquirer Monitoring Program (VAMP) is a cornerstone of the Visa payment ecosystem, designed to uphold security, trust, and compliance. By targeting excessive chargebacks and fraudulent activity, VAMP ensures that transactions remain reliable for acquirers, merchants, and consumers alike. With significant updates set to take effect globally in 2025, understanding how VAMP operates and what these changes mean is essential for stakeholders aiming to thrive in an evolving payment landscape.

What is VAMP?

VAMP is a comprehensive monitoring system created to ensure that both acquirers and merchants uphold high standards in transaction security. By tracking performance metrics, including chargeback rates and fraud losses, Visa aims to prevent behaviors that could compromise the payment system's reliability.

Primary Goals of VAMP:

- Maintain Transaction Integrity: By monitoring fraud and dispute occurrences, Visa can detect and mitigate risks early.

- Ensure Compliance: Acquirers are responsible for keeping their merchants compliant with Visa’s standards. This involves regular reviews of transaction data, robust monitoring systems, and taking corrective action when issues are detected.

- Apply Penalties for Non-Compliance: Failure to meet VAMP standards can lead to significant consequences, such as fines, increased scrutiny, and potential loss of transaction processing privileges.

Key Components of VAMP: VDMP and VFMP

Currently, VAMP includes five monitoring programs, with the Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP) being the most prominent:

Visa Dispute Monitoring Program (VDMP): Focuses on minimizing disputes and maintaining consumer trust.

- Standard Program: Merchants enter VDMP if they exceed 100 chargebacks and have a dispute-to-sales ratio of 0.9% or higher.

- Excessive Program: Merchants with over 1,000 chargebacks and a 1.8% dispute ratio face severe penalties and closer scrutiny.

Visa Fraud Monitoring Program (VFMP): Targets merchants with high fraud rates.

- Standard Program: Monitoring begins at $75,000 in fraud losses with a fraud-to-sales ratio of 0.9%.

- Excessive Program: Merchants exceeding $250,000 in fraud losses and maintaining a 0.9% fraud ratio face strict penalties and must adopt comprehensive fraud prevention measures.

Other integrated systems include the Visa Chargeback Monitoring Program (VCMP), Visa Fraud Performance Program (VFPP), and Visa Chargeback Compliance Program (VCCP). Together, these programs form the backbone of Visa’s monitoring framework.

Upcoming Global Changes to VAMP in 2025

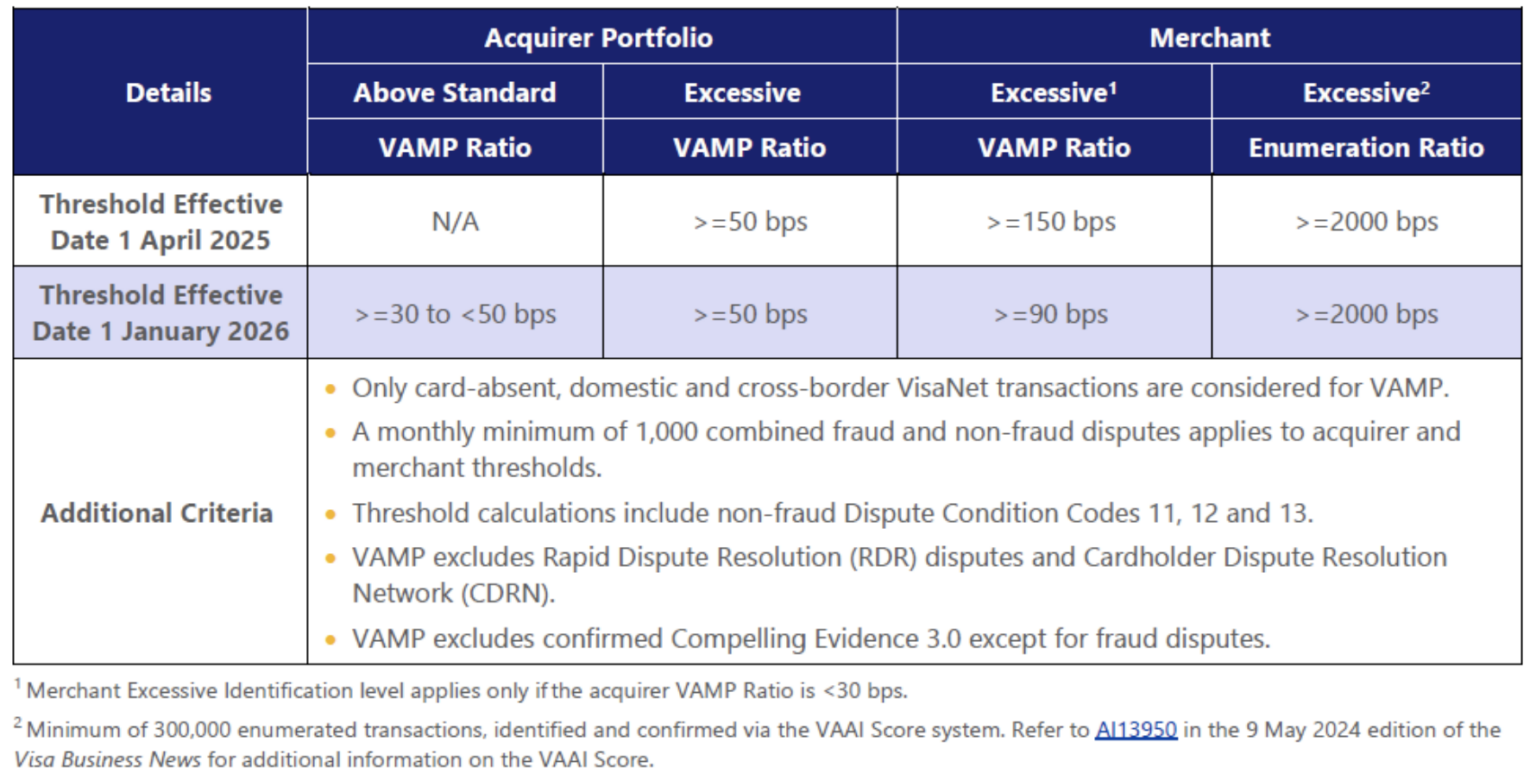

April 1, 2025, Visa will introduce significant updates to VAMP, aimed at enhancing compliance and strengthening fraud prevention globally.

source: ChargebackHelp

Key Changes:

- Consolidation of Programs: VDMP and VFMP will merge into a single program, streamlining compliance and enforcement.

- Lower Thresholds:

From April 1, 2025, the "above standard" threshold for acquirers will drop from 0.9% to 0.5%.

From April 1, 2026, the threshold will reduce further to 0.3%.

- Stricter Penalties: The "excessive" category remains at 0.9%, but penalties for violations will become more severe, including increased financial repercussions and potential processing restrictions.

- Combined Metric: Fraud and non-fraud disputes will be measured under a single metric, increasing the risk of threshold breaches.

- Exclusions from Calculations: Disputes resolved via Rapid Dispute Resolution (RDR), Verifi's Cardholder Dispute Resolution Network (CDRN), and Compelling Evidence (CE) 3.0 will be excluded from ratio calculations.

- New Fraud Detection Systems: Metrics like the Visa Account Attack Intelligence (VAAI) Score will enhance fraud detection, targeting account takeovers and synthetic identities.

- Removal of Early Warning Stage: The elimination of early warning thresholds means businesses must adopt proactive monitoring systems to address risks in real time.

- Remediation Plan Requirement: Acquirers flagged under the program will need to submit a remediation plan within 15 days, outlining steps to address performance issues.

Insights from DisputeHelp

To provide additional insights into the upcoming changes to VAMP, we reached out to DisputeHelp, a trusted partner in dispute and fraud management, to share their perspective. Tsonyo Atanasov, Sales Director EMEA at DisputeHelp, offered a balanced view of the program’s benefits and challenges, highlighting its implications for merchants and acquirers alike.

According to Atanasov, the consolidation of the Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP) into the unified VAMP framework introduces significant enhancements to compliance management. A key improvement is that dispute resolutions handled through tools like CDRN, RDR, and Order Insight, including CE3.0 transactions, will no longer contribute to merchants’ dispute ratios. Additionally, Visa’s commitment to monthly monitoring of merchant performance ensures ongoing oversight under the new VAMP structure.

“At its core, VAMP provides merchants and acquirers with more actionable ways to manage disputes and fraud, but it also raises the bar for compliance,” Atanasov explains.

He outlined both the advantages and challenges of the updated framework:

The Good:

- The availability of post-authorization solutions offers clear paths to address disputes effectively.

- Resolutions processed through Visa and Verifi are exempt from ratio calculations, reducing the burden on merchants committed to proactive dispute management.

- The program introduces an actionable framework for addressing TC40 data, enabling merchants to respond more effectively to fraud risks.

The Challenges:

- Stricter dispute thresholds require enhanced oversight and robust management practices.

- Increased fraud and disputes place greater liability on acquirers, who must adopt more comprehensive compliance measures.

- Rising compliance costs for acquirers may be passed on to merchants, even those already compliant.

The Cost:

- Merchants and acquirers must "opt-in" to Visa and Verifi’s dispute management services. This includes tools like Verifi's Order Insight, Compelling Evidence 3.0, and Visa Rapid Dispute Resolution (RDR) to achieve lower dispute ratios under the updated framework. Disputes resolved through these services will not count towards the dispute and fraud ratios.

- The financial burden of compliance could strain budgets, particularly for merchants already meeting Visa’s current standards.

Atanasov concludes, “While the updated VAMP framework demands more rigorous compliance, it equips stakeholders with the tools to maintain a more secure and transparent payment ecosystem.”

Best Practices for Staying Compliant with VISA VAMP

Successfully managing the updated VAMP framework requires both acquirers and merchants to adopt proactive and collaborative strategies. By focusing on fraud prevention, dispute management, and transparent operations, stakeholders can stay compliant while minimizing risks. Insights from DisputeHelp provide additional actionable guidance.

Strengthen Fraud Prevention

Merchants should implement robust tools such as Address Verification Service (AVS), CVV validation, and real-time fraud detection systems to mitigate risks associated with fraudulent transactions. Acquirers play a crucial role by monitoring merchant portfolios, tracking fraud ratios, and identifying high-risk merchants early. Advanced fraud detection solutions are essential for both parties to prevent escalation.

DisputeHelp’s View: “Preventing fraud requires merchants and acquirers to align their strategies. Tools like Verifi Order Insight provide transparency and enable proactive fraud mitigation from first-party fraud,” explains Atanasov.

Improve Dispute Resolution

Merchants must focus on preempting disputes by using solutions such as Rapid Dispute Resolution (RDR) and Visa Order Insight to address customer concerns before they escalate to chargebacks. Proactively resolving disputes also involves clear payment descriptors, transparent refund policies, and engaging customers to prevent misunderstandings.

Acquirers can support merchants by offering training on dispute prevention, analyzing chargebacks to uncover root causes, and providing guidance on compliance expectations. Partnering with chargeback management experts can further enhance outcomes by helping merchants compile Compelling Evidence 3.0 and effectively leverage Visa’s dispute management tools.

DisputeHelp’s View: “Collaboration between acquirers and merchants is key to reducing disputes. Sharing data and insights ensures a more efficient resolution process,” adds Atanasov.

Monitor and Track Metrics

Regularly reviewing transaction data is essential for both merchants and acquirers. Merchants must monitor fraud and dispute performance to identify trends and adjust practices accordingly. Acquirers, in turn, should maintain consistent oversight of merchant activity, using advanced tools to ensure compliance with VAMP thresholds.

Engage in Transparent Communication

Clear communication between acquirers, merchants, and customers builds trust and reduces risks. Merchants can proactively address customer concerns to prevent disputes, while acquirers should maintain open lines of communication with merchants to outline compliance requirements and provide ongoing support.

DisputeHelp View: “Transparent communication and alignment between acquirers and merchants not only ensure compliance but also fosters stronger partnerships,” says Atanasov.

Conclusion

Visa’s VAMP updates in 2025 represent a significant step forward in ensuring transaction security and compliance. While the new framework demands greater oversight and more rigorous practices, it also provides stakeholders with the tools needed to thrive in a more secure payment environment. As the industry continues to evolve, proactive strategies and collaboration will be critical for success.

At CatalystPay, we are committed to supporting merchants and acquirers through this transition. For tailored solutions and expert guidance, contact us today.