AML in Payments: Why It’s Crucial for Financial Security | POV with CatalystPay Experts

- 15 min read

- 28 august 2024

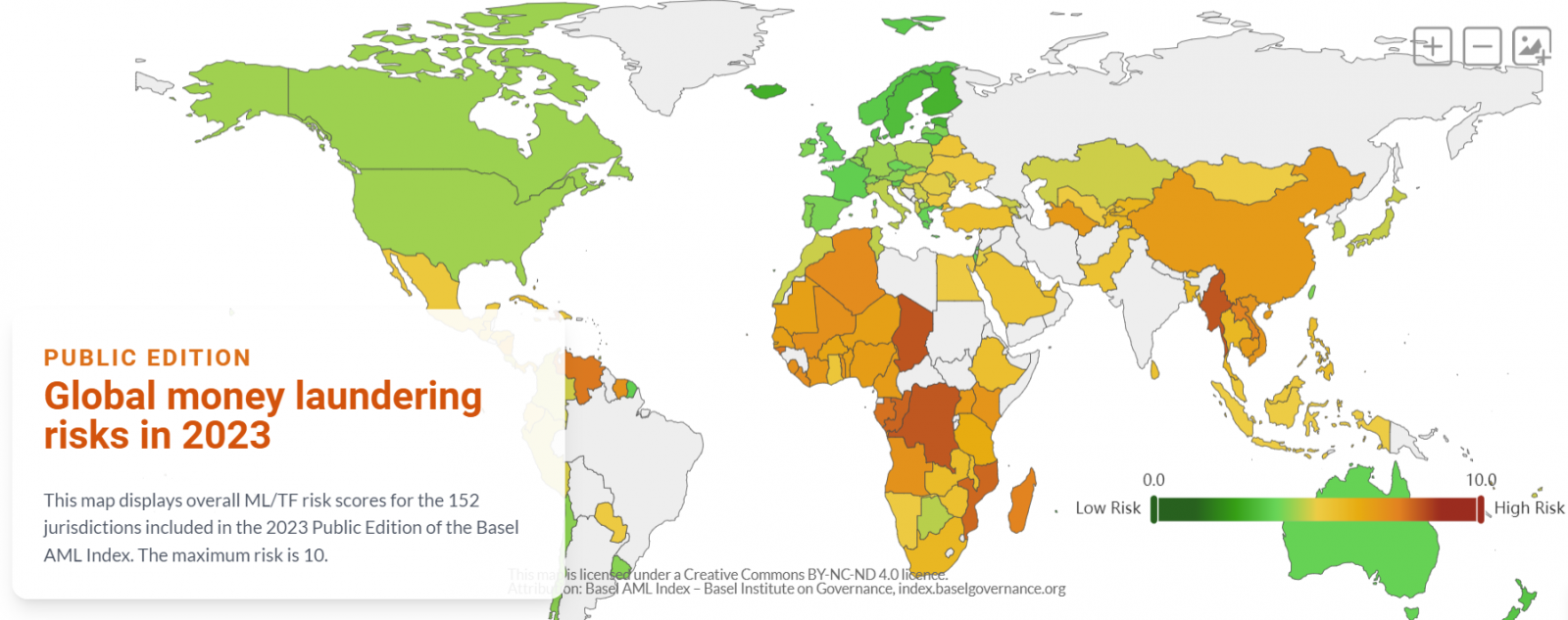

Anti-Money Laundering (AML) practices have become not just a fundamental pillar in maintaining the integrity and stability of the global financial system. For businesses involved in the payments industry, understanding and implementing effective AML measures is crucial. These practices help prevent financial crimes such as money laundering and terrorist financing, protecting not only financial institutions but also the broader economy.

At CatalystPay, we recognize the importance of these safeguards, and our experts, Anna Miteva, Head of Underwriting and CAMS, and Bella Dimitrova, Underwriting Manager and seasoned compliance lead are here, to share their insights on the evolving role of AML in the payments industry and its significance for businesses and financial institutions alike.

.png)

Why is AML important for the financial industry as a whole?

Anna Miteva: Money laundering and terrorist financing can have huge consequences, both socially and economically, affecting not just individuals but entire industries and regions. When countries fail to put strong Anti-Money Laundering (AML) measures in place, it can lead to weakened financial institutions, loss of foreign investments, and even increased crime and corruption. The risks are huge, including reputational damage for businesses and entire countries. If a country is seen as a "money laundering haven," it can become a target for criminals, while financial organizations might restrict business in that market.

"When countries fail to put strong Anti-Money Laundering measures in place, they risk becoming a 'money laundering haven,' making them targets for criminals and restricted markets for businesses."

In online payments, the impact can be felt by both merchants and banks. Business owners may find it harder to enter certain markets and will likely have to spend a lot of time and resources proving their legitimacy. This can mean lost business opportunities and increased frustration, especially for businesses based in countries flagged as high-risk. Even if a company is operating legitimately, its location can raise red flags, making it tough to build partnerships and gain trust.

From the bank’s perspective, they’ll be more cautious about taking on clients they aren’t sure about. Banks often tighten their onboarding processes, applying stricter due diligence, and may limit payment processing until the business has proven itself. By doing so, they protect both themselves and consumers from potential risks. Moreover, financial institutions that don’t comply with AML regulations face serious penalties, including fines, loss of licenses, and even imprisonment.

Bella Dimitrova: Short answer is: AML is essential for the health and stability of the financial industry. By preventing money laundering and terrorism financing, AML ensures the integrity of the global financial system. It empowers financial institutions to identify and manage risks, fostering trust and confidence among customers and regulators. Furthermore, effective AML compliance plays a crucial role in safeguarding our society by disrupting illicit activities and promoting economic transparency.

source: https://index.baselgovernance.org/

How have AML regulations evolved over the past few years, and what impact has this had on the payments industry?

Anna: Staying compliant with AML regulations has become more complex in recent years. Compliance now often involves a range of tasks like staff training, improving due diligence processes, and enhancing reporting systems. This complexity can be costly in terms of time and resources, especially as the regulations are constantly evolving. Business owners and employees need to stay up to date with any changes, particularly those operating across borders where regulations might differ or even conflict.

Technology has played a big role in making compliance more efficient. Tools like machine learning, data analytics, and better transaction monitoring have made it easier to detect suspicious activities. However, these same advancements have vulnerabilities that criminals can exploit. New payment methods, like crypto and mobile payments, also pose challenges because of their anonymity and global reach, which complicates AML efforts.

"Technological advancements like machine learning and data analytics are making it easier to detect suspicious activities, but they also come with vulnerabilities that criminals can exploit."

Bella: Firstly we need to consider that one of the main drives in the ever evolving regulations sphere is the technical and creative sophistication of financial crime. The regulatory landscape has expanded to try and encompass a wider range of financial institutions, stricter customer due diligence requirements and enhanced reporting obligations. Particular focus in the recent years has been the emerging of artificial intelligence which has reshaped the financial and compliance functions. All of these developments have led to substantial investments in compliance infrastructure, risk assessment methodologies and employee training. The very same measures however introduce another operational challenge - the cost and speed of transactions.

Can you discuss a recent AML policy change and its effects on both merchants and the payments industry?

Anna: In April 2024, the European Union announced the creation of a new body called the EU Anti-Money Laundering Authority (AMLA), which will help strengthen cooperation between countries. This new authority will work closely with Financial Intelligence Units (FIUs) and establish a rulebook to guide EU member states.

Some of the changes include stricter requirements for the crypto sector and more thorough due diligence processes. One key change is the reduction of the ownership threshold for high-risk sectors to 15%, meaning more entities will need to undergo due diligence. There will also be a centralized register of beneficial owners and bank accounts across the EU to help track financial flows and spot suspicious activities.

For merchants and banks, these changes mean longer onboarding times, stricter monitoring, and tighter requirements. However, the goal is to create a more secure financial system that’s better equipped to prevent criminal activity.

Bella: While not directly aimed at merchants, the 2024 Data Act will have an indirect impact. The Act promotes data sharing between businesses and the development of data-driven services. For merchants, this could mean gaining access to useful data that can help improve their services, such as getting data from logistics providers to optimize deliveries.

However, it also introduces new data-sharing obligations for businesses, especially those handling large datasets. Merchants will need to be aware of who owns the data and how they can use it, which could affect their business models.

What do you see as the future of AML in the payments industry?

Anna: As payment methods evolve, stronger AML measures are becoming more urgent. Criminals are getting more creative and better at avoiding detection, so the payments industry needs to step up its efforts. Advances in technology, like better screening and monitoring systems, will help identify potential threats more efficiently, but these systems take time to implement.

One strategy that will always help is improving collaboration between regulators, institutions, and countries. By sharing information and working together, we can come up with better ways to combat money laundering and other illegal activities.

Bella: I’m excited about the potential of technology, particularly in areas like biometric authentication and identity verification. If implemented correctly, these tools can reduce onboarding time and costs, while also preventing fraud. I believe we need to see more regulatory evolution and stronger collaboration between different parties to keep up with these advancements. There are already great examples, like the upcoming UBO shared register, biometric and pixel analysis in verification, and compliance organisations such as FINTRAIL which promote news and data sharing etc.

What advice would you give to merchants to help them stay compliant with AML regulations?

Anna: The best way for merchants to stay compliant is to always be aware of the latest regulations and standards. For regulated businesses, having a dedicated Money Laundering Reporting Officer (MLRO) or Compliance Officer is essential. These officers play a key role in shaping a company’s policies and making sure its operations are aligned with both local and international AML rules. They’re also the ones who report suspicious activities and protect the business from potential risks.

Acquiring banks also perform thorough due diligence on businesses to make sure they’re compliant. Merchants might get frustrated by the constant requests for information, but it’s important to remember that these requests are there to protect both the business and its customers. At CatalystPay, we always advise our clients to respond promptly to bank requests, as this will help avoid fines, restrictions, and other penalties.

Bella: Staying informed is key, though it’s easier said than done. If you’re not able to do it yourself, consider subscribing to targeted newsletters that provide updates on regulations in your industry. Another important step is to work with trustworthy partners who are also committed to compliance. And don’t forget about employee training—keeping your team up to date ensures that your business stays ahead of compliance changes and sets clear expectations for clients and partners.

"Staying informed is key, though it’s easier said than done. If you’re not able to do it yourself, consider subscribing to targeted newsletters that provide updates on regulations in your industry."

What final thoughts do you have on the importance of AML and the role of CatalystPay in supporting the industry?

Anna: Being an intermediary between banks and clients, CatalystPay plays two major roles in helping the industry.

As consultants, we educate and advise our merchants on the importance of being compliant and the ways to achieve it. We often explain the reasons behind asking for supplementary information, propose additional measurements and provide constant support during the business relationship.

As partners of the acquiring banks, we lead the communication between the acquirers and clients. We do our best to introduce only merchants that would fit into the acceptance policy and risk appetite of a certain bank, assist in completing bank’s requests during and after merchant onboarding, and cooperate in an adequate and timely manner in cases when issues arise. Moreover, we regularly take a proactive approach and implement restrictions on our end if there are any red flags and reasons to believe that merchants might be involved in fraudulent activities.

Bella: Here at CatalystPay we try to keep the balance between our clients and our partners. By acquiring and giving access to a versatile network of options we promote a healthy outlook of what the industry requirements are, how we can achieve a successful outcome in a timely manner and above all keep an eye on the ever changing financial industry.

Conclusion

As the financial landscape continues to evolve, so must our approach to combating financial crime. AML practices are essential for fostering a safe, transparent, and trustworthy payments ecosystem.

By staying informed, leveraging advanced technologies, and maintaining robust compliance frameworks, businesses and financial institutions can help safeguard the financial system against illicit activities.

At CatalystPay, we are committed to supporting our clients through this journey, and we’re here to answer your questions and to improve your business bottom line with our decades worth of cumulative expertise.