What is an ISO in Payments | A complete guide

Running a business today means needing efficient and reliable ways to process payments. Independent Sales Organizations (ISOs) can help make this easier. ISOs act as intermediaries between your business and acquiring banks, providing a range of payment services and solutions. Let's dive into what ISOs do and how they can benefit your business.

What is an ISO in Payments?

An Independent Sales Organization (ISO) is a third-party entity authorized by acquiring banks to market and sell their payment processing services to merchants. ISOs can be large companies or individual entrepreneurs, using partnerships with acquirers and gateways to offer various services, including setting up merchant accounts and maintaining payment processing systems so businesses can accept credit card payments.

Once an ISO signs up your business to accept credit card payments, they earn a commission. Additionally, ISOs might charge you a percentage of each transaction or a monthly service fee. However, ISOs don't handle your funds directly—that's the responsibility of the acquiring bank.

ISOs are particularly valuable for small and medium-sized businesses that might lack the resources or expertise to manage their own payment processing systems. They can help navigate the complexities of payment processing and find the right solutions for your needs.

What Does an ISO Do?

While some ISOs act purely as mediators, offering basic services like merchant account setup and customer support, others provide a full suite of services, including gateway technology, fraud prevention, and ongoing support.

Here's what they typically do:

- Merchant account setup: ISOs assist businesses in setting up merchant accounts, which are necessary for accepting credit and debit card payments.

- Payment processing: Some ISOs offer comprehensive payment processing solutions, including their own payment gateway technology.

- Customer support: ISOs provide ongoing support to help resolve issues and optimize payment processing systems.

- Fraud prevention and security: Many ISOs offer fraud prevention and monitoring services to protect businesses from fraudulent transactions.

- Strategic consultation: ISOs often provide strategic advice on how to manage and optimize payment processing.

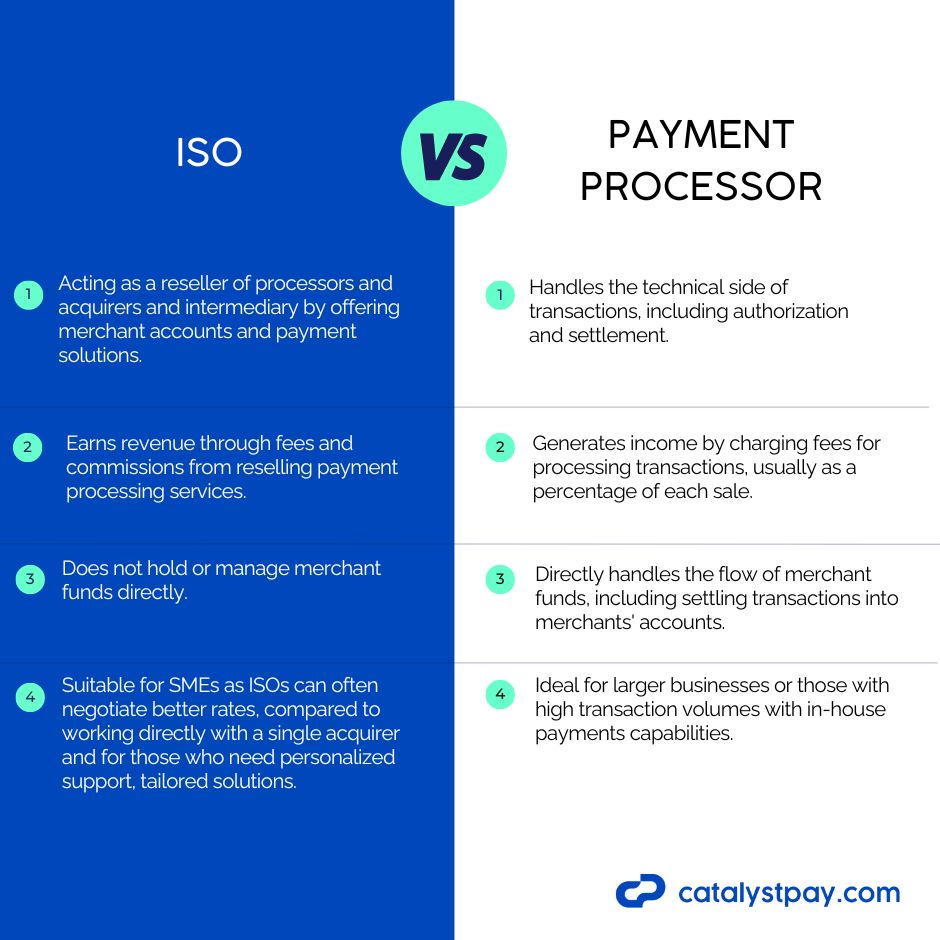

ISO vs. Payment Processor

You might wonder how ISOs differ from payment processors. Here's a quick breakdown:

- Function and role: ISOs focus on sales and customer service, acting as intermediaries and offering merchant accounts and payment solutions. Payment processors handle the actual processing of transactions, managing the technical aspects like authorization and settlement.

- Relationship with merchants: ISOs are at the frontline and build direct relationships with businesses, offering personalized support and tailored solutions. Payment processors typically have a more technical role and may not engage directly with merchants.

- Revenue model: ISOs earn revenue through fees and commissions on the payment processing services they resell. Payment processors generate income by charging fees for processing transactions, often based on a percentage of each sale.

In short, ISOs provide the sales and support expertise, while payment processors manage the technical aspects of transactions.

ISO vs. PayFac

Payment Facilitators (PayFacs) are another key player in the payment processing world. They serve as intermediaries between merchants and acquiring banks but operate differently from ISOs:

.jpg)

- Aggregation model: PayFacs onboard merchants under their own master merchant identification number (MID), streamlining the approval process for credit card processing. ISOs typically set up each merchant with their own MID, which can involve more paperwork and a longer approval process.

- Speed and efficiency: PayFacs can often get merchants up and running quickly, sometimes within hours or days. ISOs may take longer due to the individual setup process for each business.

- Risk management: PayFacs assume more risk, as they are responsible for all their sub-merchants' actions. ISOs share the risk with the acquiring bank and individual merchants. However, the faster setup by PayFacs may come with the risk of less thorough underwriting in advance, potentially exposing merchants to greater risks.

- Processing limits: PayFac solutions have processing volume caps. For instance, Visa and MasterCard impose a one-million-dollar annual limit on "sub-merchants." Businesses exceeding this threshold must obtain traditional merchant accounts.

Using an Independent Sales Organization (ISO)| The Pros and Cons

Working with an Independent Sales Organization (ISO) can offer a range of benefits for businesses looking to streamline their payment processing and expand their capabilities. However, like any business decision, it’s important to weigh the potential advantages against the possible drawbacks. The table below provides a detailed comparison of the pros and cons associated with using an ISO to help you make an informed decision.

| Aspect | Pros | Cons |

|---|---|---|

| Access to Multiple Acquiring Banks | Access to a variety of financial institutions and processing solutions, offering flexibility and options. | May involve dealing with multiple bank policies and requirements, leading to potential complexities. |

| Diverse Payment Methods | Enables acceptance of various payment methods, meeting diverse customer preferences. | Managing multiple payment methods can complicate reconciliation and reporting. |

| Multiple Processing and Settlement Currencies | Facilitates international transactions, making global business easier. | Currency conversion fees and exchange rate fluctuations might increase overall costs. |

| Cost Savings | Potential for negotiated lower rates and fees, leading to cost savings. | Perception of higher fees when compared to working directly with a single acquirer. |

| Personalized Service | Offers tailored customer support, helping navigate complex payment processing. | Reliance on the ISO’s support team, which may vary in responsiveness and expertise. |

| Flexibility and Scalability | Scalable payment solutions that can grow with your business needs. | Scaling might require additional integration or adjustments, adding to operational complexity. |

| Comprehensive Solutions | Provides extra services like fraud prevention and chargeback management, offering a holistic solution. | Additional services may come with extra costs, potentially increasing expenses. |

| Simplified Payment Processing | Streamlines the payment setup process, reducing initial setup effort. | Over-reliance on the ISO might lead to less direct control over the setup process. |

| Speedy and Handheld Setup | Efficient onboarding process with support at each step, ensuring quick start. | Potentially slower onboarding compared to PayFacs due to more thorough individual account setups. |

| Complexity | Leverages ISO expertise to manage complex payment processes on your behalf. | Understanding the ISO's role and the broader payment ecosystem can be time-consuming and challenging. |

| Dependence on Third-Party Services | Benefit from established relationships with third-party processors and gateways. | Coordination challenges may arise from relying on multiple third-party service providers. |

| Control | Reduces the need for direct involvement in payment processing arrangements. | Less direct control over processing decisions and possible dependency on ISO’s terms and conditions. |

Who Should Consider Using an ISO?

ISOs are ideal for various types of businesses that need tailored payment processing solutions and personalized support. Here are some typical businesses that benefit from working with ISOs:

- Small and Medium-Sized Enterprises (SMEs): SMEs often lack the resources and expertise to manage their own payment processing systems. ISOs provide comprehensive support and cost-effective solutions.

- Startups: Startups beginning to accept payments can benefit from the streamlined setup process and personalized service that ISOs offer.

- E-commerce Businesses: Online businesses require robust payment processing solutions to handle high volumes of transactions securely. ISOs provide the necessary technology and support.

- Retail Businesses: Brick-and-mortar stores needing efficient point-of-sale systems and payment processing capabilities can rely on ISOs for setup and ongoing support.

- Travel, Hospitality and Service Industries: Travel agents, hotels, and service-based businesses often deal with diverse payment methods and require reliable payment processing solutions.

- High-Risk Businesses: Businesses in high-risk industries, such as online gaming or crypto, may find it challenging to secure payment processing services directly from acquirers. ISOs can help by leveraging their relationships with multiple acquiring banks.

Common Misconceptions About ISOs

There are several misconceptions about ISOs. Let's clear up some common myths:

Misconception 1: ISOs Have Higher Fees Many believe ISOs charge higher fees compared to direct acquirers. In reality, ISOs often leverage their relationships with multiple acquiring banks to secure competitive rates. For example, CatalystPay, an ISO working with over 30 acquiring banks, offers wholesale discounts to small and medium-sized enterprises (SMEs), often providing better pricing than going directly to the acquirer.

Misconception 2: ISOs Lack Technology Some think ISOs are purely service-oriented with no technological infrastructure. This isn't true. Many ISOs invest in technology to enhance their service offerings. For instance, CatalystPay has its own payment gateway, allowing merchants to connect seamlessly with acquiring partners and process transactions efficiently.

Misconception 3: ISOs Are Not Safe A common misconception is that working with an ISO is less secure than dealing directly with an acquirer. However, ISOs do not handle funds, and merchants contract directly with the acquirer. Additionally, ISOs are accountable for the merchants they onboard, ensuring that security and compliance standards are met.

Misconception 4: Slower Merchant Account Opening and Onboarding Some businesses assume ISOs take longer to onboard merchants compared to PayFacs. While ISOs may have a more involved onboarding process due to individual merchant account setup, this thorough approach often results in more tailored solutions and stronger partnerships with acquiring banks.

Conclusion

Independent Sales Organizations (ISOs) are essential for businesses looking for a wide range of payment processing solutions. By acting as intermediaries between merchants and acquiring banks, ISOs offer valuable expertise and personalized service to help businesses navigate payment processing complexities. Despite common misconceptions, ISOs provide competitive pricing, technological innovation, and a commitment to security, making them a valuable partner for businesses of all sizes.

When choosing an ISO, consider factors such as reputation, service offerings, and technological capabilities to ensure you select a partner that aligns with your needs. By partnering with a reputable ISO like CatalystPay, you can unlock the full potential of your payment processing capabilities and achieve greater success.

FAQs

-

What is the primary role of an ISO in payments?

The primary role of an ISO is to act as an intermediary between merchants and acquiring banks, providing businesses with access to payment processing solutions and services.

- Can an ISO offer better rates than going directly to an acquirer?

Yes, ISOs can often negotiate better rates with acquiring banks and offer competitive pricing to merchants, especially small and medium-sized enterprises.

- Is it safer to work directly with a payment processor rather than an ISO?

Working with an ISO is just as safe as working directly with a payment processor, as merchants contract directly with acquirers, and ISOs prioritize security and compliance.

- What should businesses consider when choosing an ISO?

Businesses should evaluate factors such as the ISO's reputation, service offerings, technological capabilities, and customer support when selecting a payment processing partner.

- How do ISOs keep up with technological advancements in payments?

ISOs invest in technology to enhance their service offerings, leveraging innovations such as artificial intelligence, blockchain, and advanced analytics to stay competitive and provide value to their merchants.