How to Open a Merchant Account: A Step-by-Step Guide for Businesses

- 15 min read

- 09 may 2024

A merchant account is a type of bank account that allows businesses to accept and process electronic payment card transactions. This account is essential for any business that wants to accept payments through credit and debit cards, both online and in-store. By enabling efficient and secure payment processing, merchant accounts play a critical role in the modern commercial landscape.

The process of opening a merchant account can often seems complex and confusing for businesses. That it why we have prepared a step by step guide to help you manage the processes more easily.

What is a Merchant Account?

A merchant account is a specialized bank account that connects a business with a payment processor. When a customer makes a purchase, the funds are first deposited into the merchant account before being transferred to the business's primary bank account. This intermediary step helps in managing and verifying transactions.

Difference Between a Merchant Account and a Business Bank Account: While a business bank account holds funds and allows for general banking activities, a merchant account specifically handles credit and debit card transactions.

.png) Benefits of Opening a Merchant Account

Benefits of Opening a Merchant Account

Having a merchant account offers several advantages that go beyond just accepting payments:

- Streamlined Payment Processing: Merchant accounts facilitate quick and efficient processing of payments, reducing the waiting time for funds to be available.

- Increased Sales and Customer Satisfaction: Accepting various payment methods attracts more customers and increases the likelihood of completing sales.

- Security and Fraud Protection: Merchant accounts come with robust security features that protect both the business and the customers from fraud and unauthorized transactions.

Steps to Open a Merchant Account

Step 1: Evaluate Your Business Needs

Before applying for a merchant account, it's crucial to understand your business's specific requirements:

- Determine the Type of Merchant Account Needed: Depending on your business model, you may need an online merchant account, a retail merchant account, or a mobile merchant account.

- High-Risk vs. Low-Risk Industries: Some industries are considered high-risk due to factors like high chargeback rates, legal restrictions, or the nature of the business. High-risk businesses may face higher fees, stricter underwriting processes, and fewer provider options. It’s important to know your industry’s risk level as it can impact the terms and conditions of your merchant account.

- Understand Merchant Category Codes (MCC): Merchant Category Codes are four-digit numbers assigned by credit card networks to classify businesses by the type of goods or services they provide. It's important to know the correct MCC as it can affect your processing rates and the terms of your merchant account. Being aware of the MCC ensures compliance and can prevent potential issues with transaction approvals.

Step 2: Research Providers

Choosing the right merchant account provider is a critical step. Here’s how to go about it:

Types of Merchant Account Providers: There are various providers, including traditional banks, independent sales organizations (ISOs), and payment gateways. Each type has its own set of features and benefits.

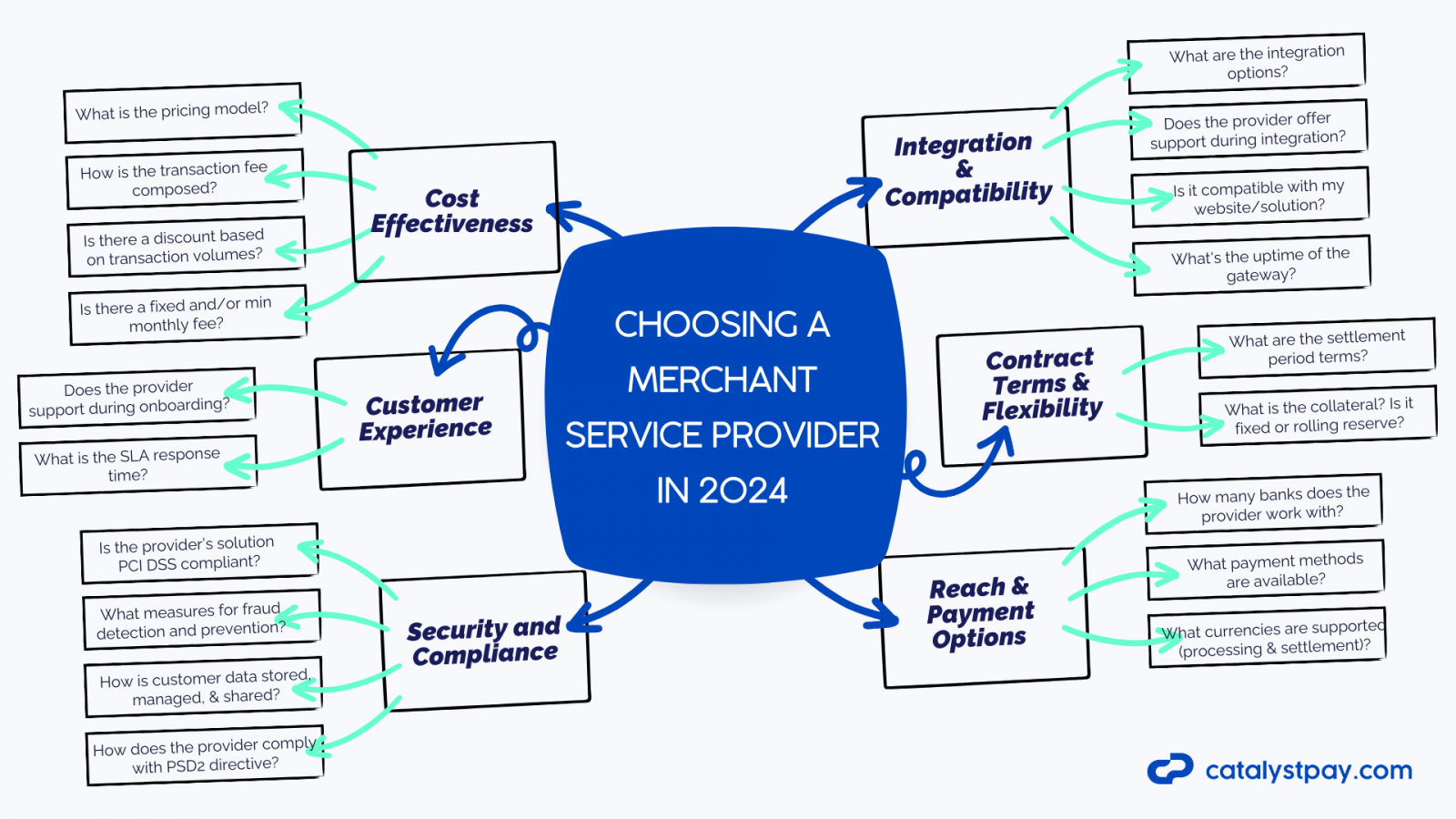

Key Factors to Consider When Choosing a Provider: Look for factors such as fees, contract terms, customer support, and additional services like fraud protection and analytics. Compare multiple providers to find the best fit for your business. Check also "Choosing A Merchant Service Provider In 2024" for detailed guidance on what to ask for when considering a merchant service provider.

Step 3: Prepare Necessary Documentation

Gathering the required documents beforehand can expedite the application process. During the merchant onboarding process, there are various documents and information required by the processor. Some of the most common ones are:

- Company documents -Certificate of Incorporation, Memorandum and articles of association, Share Certificate, Certificate of Registered Address, Certificate of Directors, etc

- Identity Documents - Passport/ID card for each director/principals

- Applying URLs

- Targeted countries

- Processing history (if such is not applicable - a business plan)

Step 4: Apply for a Merchant Account

Once you have evaluated your needs and researched providers, it's time to apply for a merchant account:

The Application Process: Fill out the application form provided by your chosen provider. This will typically include information about your business, estimated monthly processing volume, and the types of transactions you expect.

Documents submission: This is the step where the prepared documents will be requested. Remember that each merchant account provider, or acquirer, might need different set of documents for review. There might be acquirers which require first pre-check before full application process, others operate directly with full application process. For a full overview of merchant onboarding documents required, please review Merchant Onboarding - What Documents Do You Need?

Questions to Expect During the Application: Be prepared to answer questions about your business’s history, the nature of your products or services, and your financial status. This information helps the provider assess the risk and suitability of offering you a merchant account.

Step 5: Underwriting and Approval Process

After submitting your application, it will undergo an underwriting process:

What is Underwriting?: Underwriting is the process through which the merchant account provider evaluates your application to determine the level of risk your business presents. This involves reviewing your financial history, business model, and projected transaction volumes.

KYC and KYB Review: As part of the underwriting process, providers will conduct Know Your Customer (KYC) and Know Your Business (KYB) reviews. KYC involves verifying the identities of the business owners to prevent fraud and money laundering. KYB focuses on validating the legitimacy of the business, including its legal structure and financial health.

How Long Does the Process Take?: The underwriting process can take anywhere from a few days to a couple of weeks, depending on the complexity of your application and the provider’s procedures.

Potential Reasons for Application Denial: Common reasons for denial include issues with the documents provided, a high-risk business model, or incomplete documentation. Understanding these factors can help you prepare a stronger application.

Step 6: Set Up Payment Processing

Once approved, the merchant account provider (acquirer) will issue the so-called Merchant ID (MIDs). Acquirer’s integration team will set up the merchant account in their systems and provide the client with API keys and credentials to his merchant account. Once this is completed, the merchant receives all the technical information he needs to integrate the MIDs from his end.

Integrating Payment Gateways: For online transactions, you’ll need to integrate a payment gateway into your website. There are multiple ways to integrate it, depending on the business requirement, website CMS and the payment gateway integrations capabilities. Most of the cases there are Server to Server integration, which is more complex and suitable for more advanced online businesses or easier and lighter options such as payment widgets or plugins. If interested to know more about the differences between the two options, check "The expert guide to payment gateway integration: Payment Widget vs. API integration"

Setting Up Online and In-Store Payment Options: Ensure that your payment system is fully integrated and functional for both online and in-store transactions. This might involve installing point-of-sale (POS) systems, setting up mobile payment solutions, and testing all equipment.

Step 7: Test and Go Live

Before fully launching your payment system, it's important to test it thoroughly:

Testing the Payment System: Conduct comprehensive tests to ensure that the payment system works seamlessly across all platforms. This includes checking the functionality of online payments, in-store transactions, and mobile payments.

Training Staff on Using the System: Make sure your staff is well-trained on how to use the payment processing system. This includes understanding how to handle transactions, manage refunds, and address any issues that may arise.

Tips for Successfully Managing Your Merchant Account

Monitor transactions regularly

Regular monitoring of your transactions is crucial for maintaining a healthy merchant account. By keeping an eye on your transactions, you can quickly identify and address any discrepancies or fraudulent activities.

Tools for Transaction Tracking: Utilize transaction tracking tools and software that provide real-time data and analytics to help you stay on top of your payment processing activities. Most payment gateways have built-in transaction tracking systems.

Monitor chargebacks and fraud regularly

Chargebacks and fraudulent activities can significantly impact your business’s finances and reputation. Regularly review chargeback reports to identify patterns and take preventive measures. Develop a clear process for managing chargebacks and disputes to minimise their impact on your business.

Implement fraud detection tools and services offered by your payment processor to reduce the risk of fraudulent transactions. Might also consider outsourcing this to a third-party companies specialising in chargeback and dispute management

Keep close communication with your PSP

Maintaining a strong relationship with your Payment Service Provider (PSP) can help you navigate challenges and optimize your payment processes. Regularly communicate any observations, issues you might face on a daily basis as well as if you need amendments to your merchant account set up, for example new payment method or currencies. Ask for their proactive help by sending tailored made reports to your business and recommendations for processing enhancement. Your PSPs should also keep you updated on any changes or updates in their services, policies, or fees.

Conclusion

Opening a merchant account is a critical step for any business looking to accept electronic payments. By understanding the process, from evaluating your business needs to managing your account effectively, you can ensure a smooth and successful setup. At CatalystPay we understand that customer success starts with a quick and easy client onboarding process. Merchant onboarding requires a profound understanding of the rules and regulations of both credit card associations and at the regulatory level, local and global. We’ve got that covered for you. We’re supporting you from day one, before you get your merchant account. We help you start accepting online payments in 3 easy steps: you tell us what you need, we help you get your documents in order, and then you start accepting payments. Contact us and see it yourself now.

FAQs

What documents are required to open a merchant account?

Typically, you need a business license, identity documents, and financial statements. Additional documentation may be required based on the provider. For a full overview of merchant onboarding documents required, please review Merchant Onboarding - What Documents Do You Need?

Why is my business considered high-risk?

Industries with high chargeback rates, legal restrictions, large transaction volumes or within specific industries, are often deemed high-risk. This status affects the terms and costs of your merchant account.

What is the difference between KYC and KYB?

KYC (Know Your Customer) verifies the identities of the business owners, while KYB (Know Your Business) focuses on validating the legitimacy and financial health of the business.

What should I do if my merchant account application is denied?

Understand the reasons for denial, address any issues, and consider reapplying with a different provider or improving your business's financial standing.