The expert guide to payment gateway integration: Payment Widget vs. API integration

In the world of eCommerce, choosing the right payment gateway integration is a big deal. At CatalystPay, we've learned from experience that ready-to-go payment widgets like COPYandPAY often make things simpler and more effective for many businesses. However, for companies with more complex needs who need complete control over design, the server-to-server API integration can be the way to go. That's why we offer both options. In this article, we'll break down these choices, giving you a clear picture to help you decide what's best for your business.

Types of payment gateway integrations

Nowadays, the efficient and secure handling of payment processing has emerged as a cornerstone for businesses committed to delivering impeccable customer experiences. Among the essential components facilitating this crucial function are payment gateways, which come in diverse forms to cater to distinct integration preferences.

An online payment gateway is a technology-driven service that facilitates the authorization and processing of online transactions, allowing businesses to accept payments from customers via various digital channels. It serves as the virtual equivalent of a point-of-sale terminal in a physical store, securely transmitting payment data between the customer, the merchant, and the financial institution.

To give you a proper introduction, the following paragraphs explore the three primary categories of payment gateways: Self-Hosted Payment Gateways, API-hosted Payment Gateways, and Hosted Payment Gateways.

1. Payment Widget/Embedded Payment Page

This option prides itself on offering quite the compelling balance between control and compliance. Essentially, this means that the payment form is on the merchant's website, but the sensitive payment data is transmitted to the payment gateway's secure servers for meticulous processing.

As an SME, you’d choose this configuration if you’re looking to craft a customized user experience, while also entrusting the handling of sensitive payment information into the proverbial capable hands of the payment gateway. It's also applicable in the cases of merchants on popular ecommerce platforms, like WooCommerce and OpenCart who prefer using shopping carts for easy installation and configuration through payment plugin.

With CatalystPay's payment widget called COPYandPAY, the payment form is an iframe or a widget embedded on the merchant's site, so the payment data never touches the merchant's server. In essence, it offers a middle ground between hosted and server to server integration.

2.API-hosted payment gateways

This type, also known as Server-to-Server is glamorously defined as a harmonious chord between control and convenience. This happens mainly because within this type of framework customers furnish the payment data on the merchant’s website, after which said data is relayed directly to the payment gateway.

In plainer terms, the ensuing transaction is managed by the payment gateway, and the results are relayed back to the merchant’s website, with the goal of an uninterrupted user experience.

The main disadvantage of API-hosted payment gateways is that they require a lot more technical implementation and maintenance, so they’re used to cater to more complex services and brands with advanced customization needs. Moreover, in this scenario, the merchants are the ones responsible for security and PCI-DSS* compliance.

*If you’re new to this, PCI-DSS stands for Payment Card Industry Data Security Standard. And it’s exactly what it sounds like - an information security standard used to handle credit cards from major brands.

3.Hosted payment gateways

This type of integration involves directing your customers to a secure payment gateway page when they are prepared to finalize their transaction. During this step, the moment the customers input their payment details, the payment gateway oversees the entire transaction process. This choice is especially useful for merchants who are looking to uphold a higher level of security compliance, because the payment data is processed on a dedicated off-site platform, which significantly reduces the scope of PCI DSS requirements.

That said, with hosted payment gateways, merchants often have less control over the look and feel of the payment page. This can sometimes result in a disjointed user experience as customers are taken away from the merchant's website to a separate payment page.

COPYandPAY versus Server-to-Server

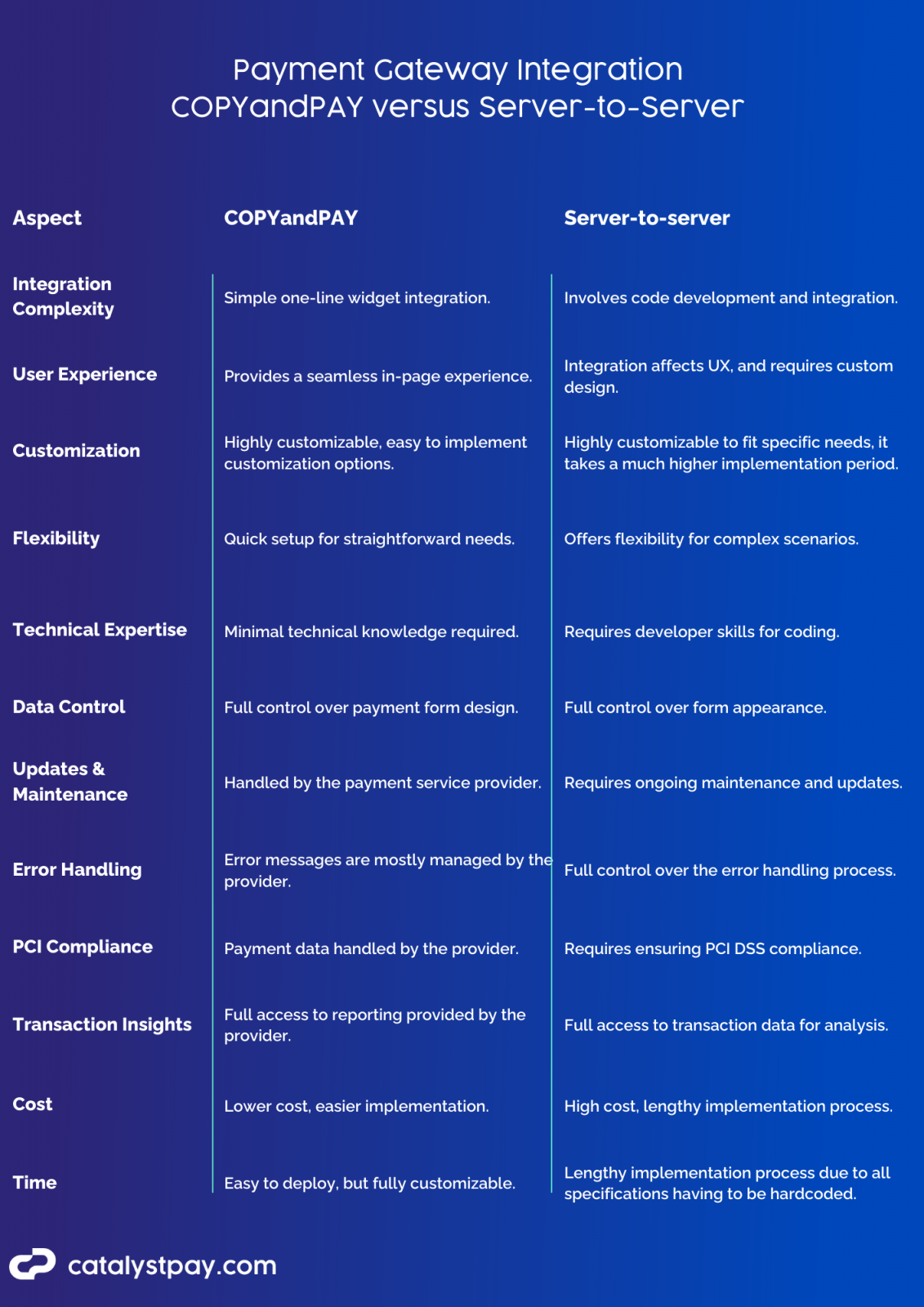

After we’ve clarified the types of integrations, it's important to delve into a key decision point: COPYandPAY versus server-to-server, the two options we believe best serve the needs of most merchants. Think of COPYandPAY as a streamlined widget framework designed for speed and simplicity. On the other hand, API integration, while potentially more intricate, is ideal for those with complex needs.

Here’s a side-by-side comparison of the two:

Key features to look for

Efficiency is the cornerstone of financial success. Seamless integration is probably the most important metric to enhance user experience and to reduce friction in the payment process.

And because the security of financial data is non-negotiable, you should also prioritize gateways with robust encryption protocols, to safeguard sensitive payment information from potential breaches. This assures customers of your commitment to their financial security.

Furthermore, specifically e-commerce speed is a competitive advantage. Try to look for gateways optimized for swift transaction processing, especially during peak periods. Compatibility across devices and platforms further ensures uninterrupted revenue flow.

In order to further maximize your business development, make sure to empower your financial strategy with insights and a data-driven approach. Opt for gateways offering comprehensive reporting and data analysis tools. It is much easier to refine your financial decision-making when you’re on top of transaction trends, customer behavior, and revenue patterns.

Next on the list is financial trust. Choose gateways that use stringent security measures, regulatory compliance, and robust fraud protection.

Read more recommendations regarding payment gateway integration in our latest interview with our tech ninja, Mihail Mihaylov.

Conclusion

In summary, the choice between COPYandPAY and server-to-server API integration boils down to the intricacy of your requirements and the level of control you wish to maintain. COPYandPAY serves businesses looking for a quick, simple, and effective solution without diving deep into technicalities, whereas server-to-server integration is tailored for those who prioritize advanced flexibility, customization, and have the resources for ongoing maintenance. However, regardless of your choice, prioritizing security, user experience, and efficiency remains paramount.

In case you have any further questions or need support for payment gateway integration, don’t hesitate to contact our expert team at CatalystPay!