What is pay by link and how can you use one?

Imagine clicking a single link and seamlessly completing a payment transaction—this is not a futuristic concept but a reality made possible by an innovative payment method known as "pay by link.". It stands out as not just an alternative payment solution but as a strategic extension of traditional payment methods. It's like building a bridge that brings businesses closer to their customers, creating more ways to engage and boost sales. With pay by link, companies can reach even more people, breaking free from the usual checkout constraints. It's a smart move for tapping into new markets and connecting with even more customers. Offering easy payment, heightened security, and a variety of payment options, it's an ideal solution for business owners, freelancers, or anyone who wants to split the bill without the hassle.

Diving into this blog post, we're going to cover all you need to know about pay by link. We'll start with the basics of how it works and then move on to how you can use this technology to your advantage. You're in for a detailed guide that aims to both enlighten and empower. So, let's start exploring the concept of pay by link, a simple yet impactful shift in the way we can further handle payments.

What is Pay by Link?

At its core, pay by link is a digital payment method that enables the sending of payment requests through a clickable payment link. Think of it as the quickest path between the person making the payment and the business receiving it. This approach makes transactions so straightforward that getting payments doesn't need complicated setups or long waiting periods anymore.

Here’s how it unfolds in the simplest terms:

- A business or individual (the payee) generates a payment request in the form of a unique link.

- This link is then sent to the customer or payer.

- The customer clicks on the link, which directs them to a secure payment page.

- They complete the payment using their preferred method.

The key players in this process are businesses or individuals sending out payment requests, payment processors that set up secure payment links and process the payment securely, and customers who use these links to make payments. This approach guarantees a smooth and secure exchange of money.

Paying with a link makes transactions easier in many ways:

- It's simple: Sending and getting payments is easy and smooth.

- It's fast: You can complete transactions quickly, without the delays typical of more traditional methods.

- It's safe: Payment processors ensure that transactions are secure, protecting both parties' financial information.

- It's flexible: You can accept different payment types, which is great for meeting everyone's needs.

When we take a closer look at pay by link, we see it's more than just a way to send and receive money. It's about making the payment process better for both businesses and customers, ensuring it's as smooth and efficient as possible. Now, let's take a closer look at how paying by link actually works. We'll go through each step in detail in the next section, making it easy to understand.

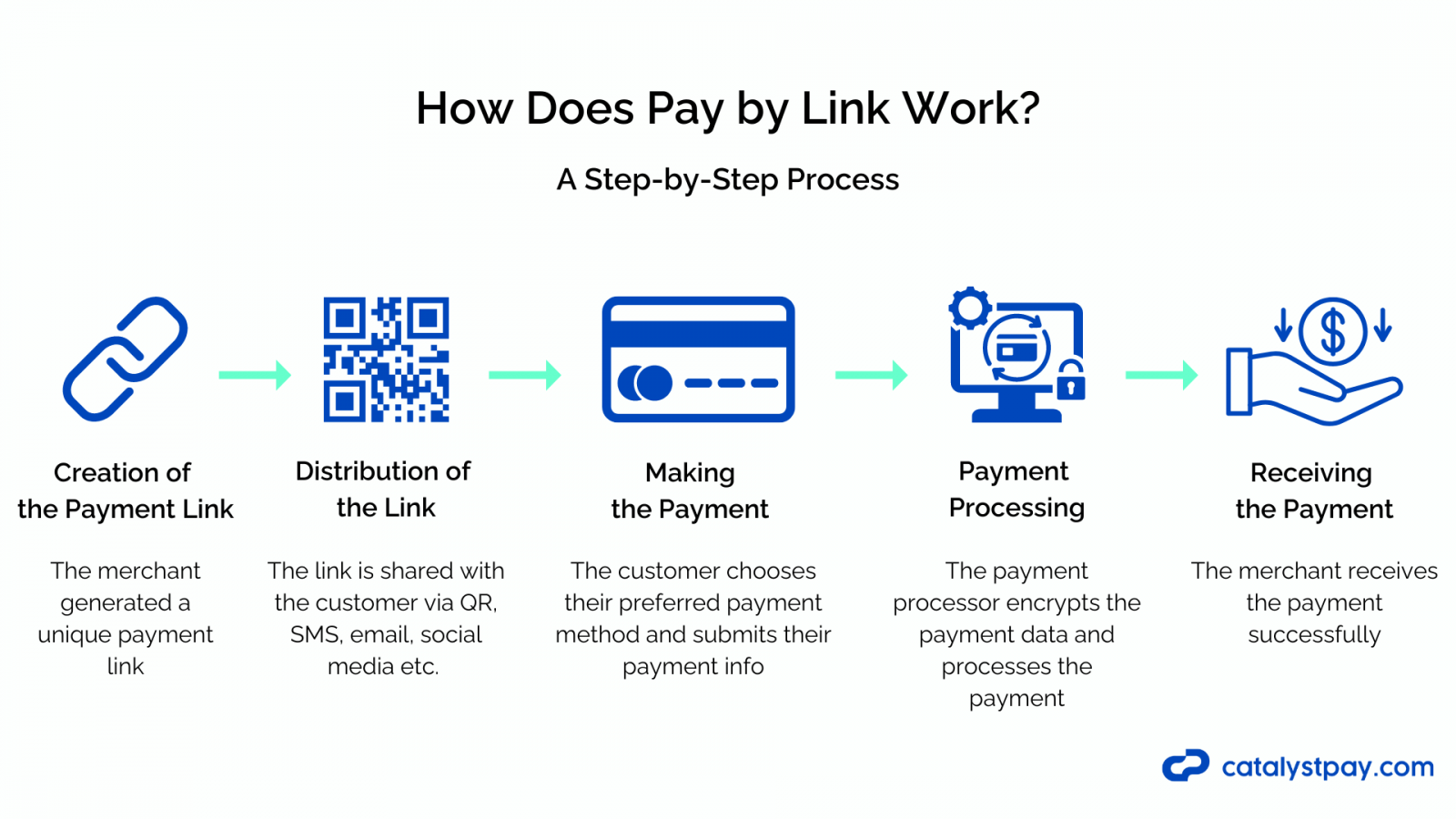

How Does Pay by Link Work? A Step-by-Step Breakdown

Pay by link makes the payment process easier for businesses by making sure transactions go smoothly from start to finish. Let's break down the process into easy-to-understand steps:

- Creation of the Payment Link: The first step involves the payee (a business or individual looking to receive payment) using a payment processor's platform to generate a unique payment link. This link is essentially the request for payment, encapsulated in a URL.

- Distribution of the Link: Next, this link is shared with the payer. It can be sent through various channels such as email, SMS, a direct message on social media, or even embedded on a website or invoice. What's great here is the flexibility – it lets you connect with the payer in whatever way they like best.

- Making the Payment: When the payer clicks on the link, they're directed to a secure payment page. Here, they can choose their preferred payment method (credit card, bank transfer, digital wallet, etc.) to complete the transaction. This step is designed to be user-friendly, offering clear instructions and options so they can finish their payment without any hassle.

- Payment Processing: Once the customer chooses their payment method and approves the transaction, the payment processor takes over. Its job is to ensure the transaction is secure and keep everyone's financial information safe. It does this by encrypting the data and following strict security standards.

- Receiving the Payment: Finally, once the transaction is successfully processed, the business receives the funds. This typically happens quickly, improving the business's cash flow and reducing the wait time you usually see with traditional payment methods.

By making the payment process simpler, payment links don't just make transactions smoother; they also improve the whole experience for businesses and customers alike. Now, let's dive into the benefits of using payment links and see why this smart method is becoming popular in different fields.

How Pay by Link Benefits Businesses and Customers

Let's be honest, online checkout processes can sometimes be complicated. Customers often have to deal with complicated forms, typing in their billing details, and sometimes, they're even asked to create a new account. Using payment links is much more than just adding a "Pay Now" button for your customers. Integrating pay by link as a complement to the standard checkout process broadens your reach, enabling transactions across various channels more seamlessly. Let's look at the main benefits that make paying with a link beneficial for both businesses and customers.

For Businesses:

- Boost Reach & Sales: With pay by link you can quickly create safe payment links. Just type in the amount and any details, then it's ready to go. This easier process means less hassle for customers, leading to faster payments and potentially higher conversion rates.

- Ultimate Flexibility: The great thing about payment links is how flexible they are. You can use it for everything from sending invoices and selling products to collecting deposits and taking donations. Whatever your business does, payment links can fit right in. Just share the links in a way that best suits your needs, and you're good to go.

- Potentially Lower Costs: Traditional payment systems usually have fees for every transaction. Choosing pay by link could give you better rates, especially for smaller amounts. It’s smart to look at the fees from different services before you decide on one.

- Security: Security is a top priority. When you use payment links, both you and your customers stay safe. Trusted payment processors put strong security in place to keep sensitive information safe and prevent fraud.

For Customers:

- Simplicity: Customers can forget about those lengthy forms. Pay by link lets them complete secure payments with just a few clicks. They simply click the link, select their payment method, and they're done. It's that simple.

- Multiple Payment Options: They are not limited to just one way of paying. Many services let them pay their way, whether that's with a credit or debit card, or even through digital wallets like Apple Pay or Google Pay. They can just pick what's easiest for them.

- Faster Checkouts: Payment links gets rid of the annoying job of typing in your billing details over and over on different websites, making the checkout process smoother. This leads to faster transactions and more satisfied customers.

Looking into payment links, it's clear that the system is designed to make things smoother and better for everyone involved. But, while we see all these benefits, it's normal to wonder: Just how safe are these transactions?

Is Pay by Link Safe?

When we talk about financial transactions, security is super important. Pay by link takes this seriously and has put in place strong security features to keep your transactions safe:

Secure Payment Gateways: They serve as the initial safeguard, making sure every transaction is handled safely through a secure, encrypted channel.

Data Encryption: Sensitive details like credit card numbers and personal information are encrypted so that only those who are supposed to see them can, making them unreadable to unauthorized parties.

PCI Compliance: Following Payment Card Industry (PCI) standards further boosts security, requiring regular audits and strong controls.

Additional Security Features: Many providers enhance safety with options like Two-Factor Authentication (2FA), which adds another level of security to protect your information.

These comprehensive security measures make payment links not just easy to use, but also super secure for everyone. Thanks to these steps, whether you're a business, a freelancer, or just someone making a transaction, you can do so with peace of mind, confident that your financial information is in good hands.

Practical Uses of Pay by Link for Everyday Business

Payment links provide flexible solutions for various business activities, improving both operational efficiency and customer experience. Let's take a look at how businesses can practically benefit from pay by link:

Optimizing Online Orders and Sales

E-commerce entities particularly benefit from payment links, which offer a straightforward path for completing online orders and sales. They can use payment links across multiple channels like SMS, chat, and email.

The process is quick, easy to follow, and entirely secure. Because of this, customers are more likely to complete their transactions without any worries. Businesses can also add a pay by link option to their website or social media platforms, making it convenient for customers to pay for their purchases instantly.

Immediate Payment through Invoices and Quotes

Businesses can speed up and streamline their payment process by adding a pay by link feature to their invoices and quotes. This method ensures transactions are completed swiftly and smoothly, cutting down on the time it takes to collect payments. In addition, businesses can customize payment links with specific amounts and descriptions for each invoice or quote.

Simplifying Recurring Payments

For handling recurring payments and subscriptions, pay by link makes it easy to automate these payments. This helps businesses keep a steady flow of income from memberships or continuous services without needing to constantly manage things manually. With payment links, customers can set up their preferred payment method and forget about it, knowing that their payments will be made regularly on time.

Enhancing In-Person Transactions

In places like stores or events, using QR codes to guide customers to a payment page can really modernize in-person transactions.

It speeds things up and aligns perfectly with people's increasing desire for contactless payments. Customers can simply scan the QR code with their phone and proceed to complete the transaction through a secure payment gateway.

Securing Deposits and Down Payments

When it comes to collecting deposits and down payments, pay by link simplifies the process, making it easier for businesses to secure commitments from their customers efficiently and reliably. This feature can significantly reduce the risk of customers backing out, especially for large-ticket items.

Facilitating Donations and Fundraising

Non-profit organizations can use payment links to make donating easier. This approach could help raise more funds and encourage people to donate more often by providing a simple way for supporters to contribute.

If you are part of CEE region (Central Eastern Europe), you can also check out our article about ways you can use payment links in scaling your business in CEE region.

Now let's have a look into how this payment option can be equally beneficial for freelancers looking to manage their invoicing and payments more smoothly.

Practical Uses of Pay by Link for Freelancers

Freelancers, too, can take advantage of the pay by link feature to simplify and secure their payment processes for different kinds of projects.

- Collecting Payment for Hourly Work: Freelancers can easily set up payment links for the precise amount owed once they've put in the hours. This straightforward method guarantees they get paid promptly and accurately for their hard work.

- Milestone-Based Payments for Projects: For bigger projects, freelancers can create several payment links for different milestones. This approach ensures a steady cash flow during the project and strengthens clear communication and trust between freelancers and their clients.

- Selling Digital Products: Payment links simplify buying and selling digital products by allowing instant access as soon as payment is made. Freelancers can effortlessly connect it with online marketplaces such as Shopify or Etsy to boost their sales process and improve the shopping experience for their customers.

When freelancers switch to payment links, they make collecting payments from clients a lot smoother and more secure for both sides. As we've covered the benefits and uses of this payment method, it's also crucial to think about a few important things before rolling it out.

Things to Consider Before Using Pay by Link

Before adding payment links to your transaction methods, it's important to carefully consider if it fit your business approach and meet your customers' needs.

Transaction Fees: When you're looking into pay by link services, the first thing to think about is the possible transaction fees. Different payment processors have different fees, and these can impact how you price your products and your overall profits. It's a good idea to really dig in and compare what's out there to find the most cost-effective solution. Note that some Payment Service Providers (PSPs) might introduce additional costs for setup or specific services related to pay by link. Also, being up-front with your customers about any extra fees can help keep the trust and avoid any unexpected surprises at checkout.

Security Measures: With the rise of data breaches and financial fraud, it's super important to make sure your pay by link transactions are as secure as can be. Go for payment processors that really take security seriously, like those that follow PCI DSS standards, and use encryption and fraud detection to keep everything safe. A secure payment setup doesn't just protect you and your customers, but also reinforces your reputation as a trustworthy seller.

Customer Familiarity and Acceptance: Even though payment links makes payments smoother, some people might be a bit hesitant about trying something new. It's super important to help them understand how it works and why it's great. Think about making some easy-to-follow guides or videos to break down how it all works, showing them it's not only convenient but also safe. Plus, having a strong customer support team ready to answer any questions about pay by link can really help make everyone feel more at ease with using it.

Incorporating payment links into your payment options requires careful consideration of these aspects to ensure a smooth and secure transaction process for you and your customers. By addressing potential fees, ensuring robust security measures, and educating your customers about the benefits and usage of pay by link, you can leverage this innovative payment method to enhance your business operations and customer experience.

Is Pay by Link Right for You?

Payment links offer a smooth and efficient way to handle payments, perfect for anyone from freelancers to big companies. It simplifies transactions, giving your customers the convenience of instant payments. Plus, it's flexible enough to handle different billing setups, whether you're charging by the hour, by project milestones, or selling digital goods. Just keep in mind, launching it requires careful consideration of the fees involved, making sure it's secure, and ensuring your customers are ready and comfortable using it.

Deciding whether payment links are a good fit for your business involves taking a good look at your sales process, understanding your customer base, and defining your financial goals. You should think about how many sales you are making, the type of products or services you offer, and whether pay by link could streamline your operations or boost customer satisfaction. Also, it's important to weigh the costs against the benefits, such as quicker, more secure transactions.

Ultimately, If you're on the lookout for a payment solution that's not only modern and secure but also flexible enough to suit different business needs and provide a smooth checkout experience for your customers, then pay by link could be just what you need. Take a close look at what your business requires and what you value to see if this payment method aligns with your operational goals and plans for growth.

Conclusion

We've explored how Pay by Link is revolutionizing the payment process, making transactions simpler, more secure, and incredibly efficient. Whether you're a freelancer, a small business owner, or running a large company, integrating pay by link can streamline your operations and provide a smooth payment experience for your customers. As with any new tool, the key to success lies in assessing whether it aligns with your business needs, customer expectations, and financial goals.

If you're looking for a modern, flexible payment solution that enhances customer satisfaction and operational efficiency, Pay by Link could be the perfect fit for your business.

Ready to implement Pay by Link for your business?

Contact us today to explore how CatalystPay can help you simplify payments and grow your business. Get in touch

FAQ

How do I use Pay by Link?

To start using pay by link, you'll first need to pick a payment processor that supports this feature. After you're all set up, you'll create a payment link for the invoice or payment you're requesting. You can then send this link to your customer using their preferred method of communication, whether that's email, SMS, or something else. When your customer clicks the link, they'll be directed to a secure payment page where they can effortlessly complete their transaction with their chosen payment method. This process is designed to be simple and efficient, making things easier for both you and your customer.

Is Pay by Link safe to use?

Yes, payment links are designed with safety in mind. The payment links are securely encrypted and run through protected servers, matching up with top security standards like SSL encryption and PCI DSS rules. Plus, since customers enter their payment details on a secure page rather than sharing them directly with sellers, it cuts down on the chance of data leaks or fraud. This makes pay by link a reliable and safe choice for online payments.

How long does it take to receive a payment through Pay by Link?

The time it takes to receive a payment via payment links can vary depending on the payment processor used and the type of payment method chosen by the customer. Typically, credit card payments are processed almost instantly, meaning funds could be available in your account within a few hours to a couple of days. Bank transfers may take longer, potentially up to several business days. It's important to consult with your payment service provider for specific timelines associated with different payment methods.

Can I use Pay by Link for international payments?

Absolutely, pay by link is a great fit for international transactions. It's a convenient method to accept payments from customers all over the globe. The key, though, is choosing the right payment processor. Some are well-equipped to handle multiple currencies and payment methods from various countries, allowing your overseas customers to pay in their own currency easily. Be aware of potential additional fees for currency conversion or international transactions, it's something to think about when you're setting up your payment options.